Can Foreigners Buy Property in Scotland?

Absolutely! Foreigners are allowed to buy property in Scotland just like Scottish citizens.

Some specific rules and regulations need to be followed by foreign buyers.

This article will discuss everything related to foreigners buying property in Scotland, including the legal requirements, taxes, and other important considerations.

Legal Requirements for Foreigners Buying Property in Scotland

If you are a foreigner looking to buy property in Scotland, you must know the legal requirements. First, you need to consider the Land and Buildings Transaction Tax (LBTT).

It is a tax that is payable when you buy property in Scotland.

As a foreign buyer, you will have to pay a higher rate of LBTT than Scottish residents. This is because foreign buyers are not eligible for first-time buyer relief.

Apart from LBTT, you will also need to obtain a Home Report. It is a document that provides information about the condition and value of the property.

This report is mandatory for all properties put up for sale in Scotland.

You can get a Home Report from a qualified surveyor.

You will also need to hire a conveyancing solicitor.

They will help you with the legal process of buying a property in Scotland. They will also ensure that the property you buy is free from legal issues.

Once you have completed the legal process, you must register the property with either the Register of Sasines or The Land Register of Scotland.

The Register of Sasines is a public register of land ownership in Scotland. At the same time, The Land Register of Scotland is a digital register that provides information about land and property ownership.

Can Foreigners Buy Property in Argentina?

Financing a Property Purchase in Scotland as a Foreigner

If you are a foreigner looking to buy property in Scotland, you must fund the purchase.

You can either pay in cash or apply for a mortgage. Several mortgage lenders in Scotland provide mortgages to foreign buyers.

You must meet specific criteria to be eligible for a mortgage. These criteria include having a good credit score, providing proof of income, and having a deposit.

The deposit requirements for foreign buyers are usually higher than for Scottish residents.

Considering currency exchange rates when financing your property purchase would be best.

Finding a reliable currency exchange provider is essential to avoid currency fluctuations affecting your purchase.

Other Considerations for Foreigners Buying Property in Scotland

Apart from legal and financing requirements, there are other considerations you need to consider when buying property in Scotland as a foreigner.

- One of the most critical considerations is residency requirements. If you plan to live in Scotland for more than six months a year, you must apply for residency.

- You must also pay income tax on any income you earn in Scotland. If you sell your property, you must pay capital gains tax. You must also pay inheritance tax if you pass away while owning the property.

- You must hire a property management company to rent your property in Scotland. They will help you find tenants, collect rent, and manage the property on your behalf.

Advantages of Owning a Property in Scotland as a Foreigner

Despite the legal and financial requirements, owning a property in Scotland as a foreigner has several advantages.

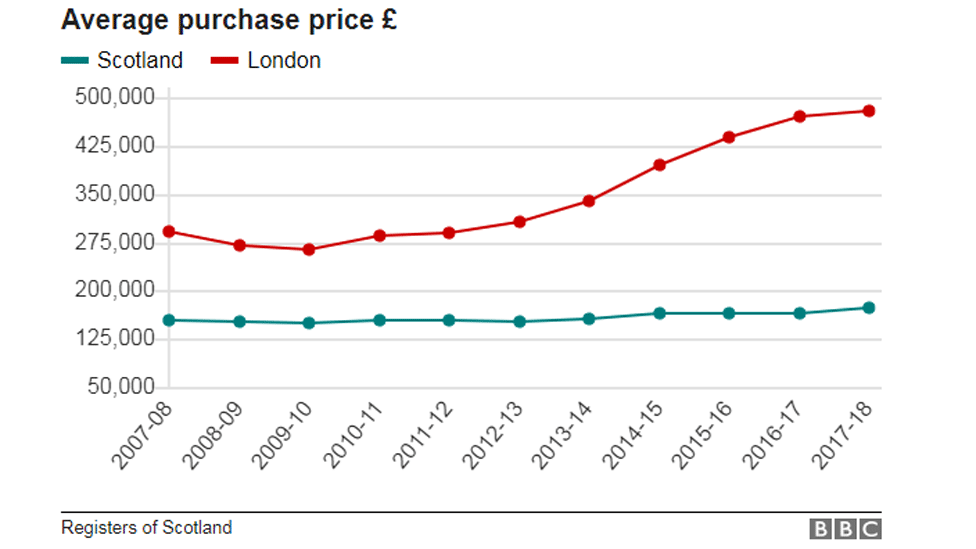

The Scottish property market is stable and has a good track record of growth. Secondly, the rental yield in Scotland is higher than in many other parts of the UK.

Scotland is a scenic and peaceful location offering an excellent quality of life.

Can Foreigners Buy Property in Argentina?

What are the rules for house buying in Scotland?

Here are some fundamental rules and regulations for buying a house in Scotland:

- There is no stamp duty land tax in Scotland. Instead, there is a Land and Buildings Transaction Tax (LBTT) that buyers pay. The LBTT rates are slightly different from English stamp duty.

- Conveyancing is slightly different in Scotland. Conveyancing lawyers are called solicitors, who handle the property transfer’s legal processes. Missives are used instead of contracts for sale.

- Mortgage rules are generally the same as in the rest of the UK. Buyers still need a deposit and mortgage approval from a lender to finance the purchase.

- Home reports are required for most home purchases in Scotland. This includes a single survey, a property questionnaire, and an energy report. The home report highlights any issues or repairs needed on the property.

- Property ownership in Scotland is different. It primarily uses another legal system called Scottish Property Law. Property ownership is recorded in the Land Register of Scotland.

- Shared ownership properties follow a similar model but are known as shared equity properties in Scotland. There are also various shared equity schemes for first-time buyers.

- Council tax operates slightly differently in Scotland. The council tax bands and rates are set by local councils instead of the central government.

How much does it cost to own a house in Scotland?

There are a few main costs involved in owning a house in Scotland:

Mortgage payments – This will likely be your highest monthly cost. Your mortgage’s interest rate and length will determine how much you pay each month.

Council tax – This local tax funds local services like schools, police, fire services, etc. Local councils in Scotland set council tax bands and rates. On average, council tax in Scotland is slightly lower than in the rest of the UK.

Home insurance – You’ll need to get home insurance to cover any damage to your property from things like fires, floods, theft, etc. Insurance costs vary based on your home and the coverage selected.

Utility bills – You’ll pay for water, electricity, gas, and internet/TV. These costs will vary based on your usage and the size of your home.

Repairs and maintenance – As the homeowner, you’re responsible for any repairs or maintenance issues. This includes replacing appliances, fixing plumbing issues, repainting, etc. In some years, you may have little to no costs. In other years major repairs could cost thousands.

Land and Buildings Transaction Tax (LBTT) – Instead of stamp duty, buyers in Scotland pay LBTT when purchasing a home. The LBTT rates are slightly different from English stamp duty.

The total monthly costs of owning a home in Scotland will vary significantly based on the type of property, the size of the mortgage, and your usage.

But on average, homeowners in Scotland spend 25%-40% of their income on housing costs.

FAQs

Can a foreigner get a mortgage to buy a property in Scotland?

Yes, a foreigner can get a mortgage to buy a property in Scotland. However, they will need to meet specific criteria, including having a good credit score, providing proof of income, and having a deposit. The deposit requirements for foreign buyers are usually higher than for Scottish residents.

What is LBTT?

LBTT stands for Land and Buildings Transaction Tax. It is a tax that is payable when you buy property in Scotland. As a foreign buyer, you will have to pay a higher rate of LBTT than Scottish residents. This is because foreign buyers are not eligible for first-time buyer relief.

What is a Home Report?

A Home Report is a document that provides information about the condition and value of the property. This report is mandatory for all properties put up for sale in Scotland. You can get a Home Report from a qualified surveyor.

Can a foreigner rent out their property in Scotland?

Yes, a foreigner can rent out their property in Scotland. They will need to hire a property management company to help them find tenants, collect rent, and manage the property on their behalf.

Do foreigners have to pay council tax in Scotland?

Yes, foreigners who own property in Scotland have to pay council tax. Council tax is a local tax that is payable to the local council. The council tax you will have to pay depends on the value of your property and the area in which it is located.

Conclusion

In conclusion, foreigners are allowed to buy property in Scotland.

Specific legal and financial requirements need to be followed.

Foreign buyers will need to pay a higher rate of LBTT than Scottish residents and hire a conveyancing solicitor to help them with the legal process.

They can also apply for a mortgage, but the deposit requirements are usually higher.

Despite these requirements, owning a property in Scotland as a foreigner has several advantages, including a stable property market, high rental yield, and excellent quality of life.