How to Buy a Section 8 Property?

If you’re looking for an affordable rental property, Section 8 housing can be a great option.

The Section 8 program is a federal government program that provides housing vouchers to low-income families and individuals.

These vouchers can be used to rent a private apartment or house that meets specific requirements.

This article provides a comprehensive guide on buying a Section 8 property.

What is Section 8 Housing?

Section 8 housing, also known as the Housing Choice Voucher Program, is a federal government program that provides rental assistance to low-income families and individuals.

The program is administered by local public housing agencies (PHAs) and provides vouchers that can be used to rent a private apartment or house that meets specific requirements.

The program is designed to help low-income households afford decent, safe, and sanitary housing.

The federal government funds the program, but local PHAs administer it.

How to Buy a Section 8 Property?

Buying a Section 8 property is similar to buying any other property.

However, there are some additional requirements you need to meet to ensure the property is eligible for the program. Here are the steps to follow:

Step 1: Find a Section 8 Property

The first step is to find a property suitable for the Section 8 program.

You can search for Section 8 properties on the websites of local PHAs or on rental listing websites that specifically cater to Section 8 tenants.

Step 2: Check the Property’s Eligibility

Before making an offer on a property, you must ensure it meets the Section 8 program’s requirements.

The property must meet specific minimum safety, sanitation, and habitability standards. The local PHA sets these standards.

Step 3: Make an Offer

Once you have found a Section 8 property that meets the program’s requirements, you can make an offer on the property.

You can work with a real estate agent or the property owner.

Step 4: Conduct a Home Inspection

Before closing on the property, you should conduct a home inspection to identify any issues that need to be addressed. This will help you determine the cost of repairs and renovations required to meet the Section 8 program’s requirements.

Step 5: Close on the Property

Once you have conducted a home inspection and addressed any issues, you can close on the property.

You must work with the local PHA to ensure the property is eligible for the Section 8 program.

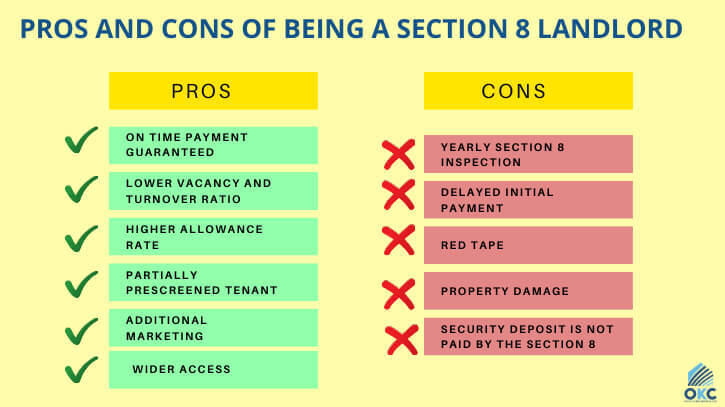

The Advantages of Being a Section 8 Landlord

Being a Section 8 landlord can have several advantages, including:

Guaranteed rent payments: Section 8 tenants receive rental assistance from the government to help cover the cost of their rent.

As a Section 8 landlord, you are guaranteed to receive a portion of the rent directly from the government, even if the tenant falls behind.

Lower vacancy rates: Since there is a high demand for affordable housing, Section 8 landlords often have lower vacancy rates than non-Section 8 landlords. This can help ensure a steady stream of rental income.

Access to a broader pool of tenants: By accepting Section 8 tenants, you have access to a wider pool of potential renters who may be unable to afford market-rate rents. This can help you find tenants more quickly and reduce the time your property sits vacant.

Reduced turnover: Section 8 tenants often stay in their units for more extended periods, as they are less likely to be able to move.

This can help reduce turnover and the associated costs of finding new tenants, such as advertising fees and maintenance costs.

Assistance with tenant screening: Section 8 programs often assist with tenant screening, including background checks and income verification.

This can help ensure that you are renting to responsible and reliable tenants.

The Disadvantages of Being a Section 8 Landlord

While there are advantages to being a Section 8 landlord, there are also some potential disadvantages to consider:

Limited rent increases: Section 8 landlords are limited in how much they can increase rent on their properties.

The amount of the increase is typically set by the local housing authority and is based on the fair market rent for the area.

Additional paperwork and inspections: Section 8 landlords must complete other paperwork and checks to participate in the program. This can be time-consuming and may require different resources.

Possible tenant issues: While Section 8 tenants are typically reliable, there is still a risk of non-payment of rent or property damage.

In some cases, Section 8 tenants may have difficulty maintaining their portion of the rent, which can strain the landlord financially.

Program changes: Section 8 programs are subject to changes in funding and regulations, which can impact landlords.

For example, changes to the program could result in reduced rental assistance or additional requirements for landlords.

The stigma associated with Section 8: Some landlords may have reservations about participating in the Section 8 program due to the stigma associated with affordable housing.

This may limit the pool of potential tenants and make it more difficult to find renters.

How to Choose Quality Tenants for Your Section 8 Property?

Choosing quality tenants for your Section 8 property is essential to ensure that you have responsible and reliable renters who will take care of your property and pay their rent on time.

Here are some steps you can take to choose quality tenants for your Section 8 property:

Screen all applicants: Screen all applicants for your Section 8 property using a consistent set of criteria.

This might include conducting background checks, verifying income, and checking rental history and references.

Look for stable income: Look for tenants with a steady income source, such as a job or government benefits.

This will help ensure that they can pay their portion of the rent on time.

Verify rental history: Verify rental account by contacting previous landlords to find out about the tenant’s payment history, whether they caused damage to the property, and whether they followed the lease terms.

Conduct a criminal background check: Conduct a criminal background check to ensure that the tenant has no violent or criminal behavior history.

Consider credit history: Consider the tenant’s credit history, but remember that Section 8 tenants may have had financial difficulties and may not have a perfect credit score.

Meet the tenant in person: Meet them before approving them to move in.

This will give you a sense of their personality and behavior and help you determine whether they will fit your property well.

Follow the Section 8 program guidelines: Make sure to follow the guidelines set by the Section 8 program for tenant selection.

This may include providing equal opportunity to all applicants and avoiding discrimination based on race, gender, or religion.

FAQs

Q1. What are the eligibility requirements for the Section 8 program?

A1. To be eligible for the Section 8 program, you must be a low-income family or individual, as the local PHA defines. You must also be a U.S. citizen or have eligible immigration status.

Q2. Can I use a Section 8 voucher to buy a property?

A2. No, Section 8 vouchers can only be used to rent a property.

Q3. How much rent will I pay with a Section 8 voucher?

A3. Your rent will be based on your income and the local housing market. You will generally pay 30% of your income towards rent, while the Section 8 voucher covers the rest.

Q4. Can I be evicted from a Section 8 property?

A4. Yes, you can be evicted from a Section 8 property if you violate the terms of your lease or fail to meet the program’s requirements.

How to Buy a Tax Deed Property?

Conclusion

Buying a Section 8 property can be an excellent investment if you’re looking for an affordable rental property.

Ensuring the property meets the program’s requirements and is eligible for the Section 8 program would be best.

Following the steps outlined in this article, you can ensure a smooth and successful purchase of a Section 8 property.