Can I Buy Property in Canada as Us Citizen

Understanding the Canadian Real Estate Market

Before you make any investments, it’s important to understand the real Canadian esessentialet. The market in Canada is quite different from the U.S., so it’s essential to do your research and learn about the different regions, their prices, and the cowothertting Financing

As a U.S. citizen, you can get financing from Canadian banks to buy a property. However, you should know that the process may be more complicated than getting a loan in the U.S. You may need to provide additional documentation, such as proof of income, credit history, and rental income.

Taxes

When you buy a property in Canada, you will need to pay property taxes. The taxes mmustmustnding on the province or territory where you buy the property. You may also be required to pay income taxes on any rental income you earn from the property.

Hiring a Real Estate Agent

Hiring a real estate agent is essential when buying a property in Canada. An experienced agent can help you find the right property, negotiate the price, and guide you through the buying process. They can also help you navigate the legal and financial requirements of buying a property in Canada.

Can an American buy a Canadian home?

Yes, Americans can buy homes in Canada. Here are the things to keep in mind:

- Americans will need a Temporary Resident Visa (TRV) or work permit to buy a home in Canada. They cannot purchase a home as a tourist.

- There are no specific restrictions on foreign home ownership in most of Canada, though some provinces have particular rules.

- Americans will need a Social Insurance Number (SIN), like a Social Security Number, to work or buy property in Canada.

- Canadians have a different tax system than the U.S., so Americans must file both U.S. and Canadian taxes. Any capital gains on the sale of Canadian property will likely be taxed in both countries.

- Americans need a Canadian bank account to pay utilities, property taxes, and mortgages.

- Mortgage rates for nonresidents tend to be higher than for Canadians. And some lenders may not offer mortgages to nonresidents.

- There may be additional legal fees when purchasing a home as a nonresident Canadian.

- While rare, some Canadian municipalities restrict the number of homes that nonresidents can own.

Can I buy a house in Canada as a non-resident?

Yes, you can buy a house in Canada as a nonresident, but there are some things to keep in mind:

- Many provinces do not restrict nonresident home ownership, but some do. Ontario, BC, and Quebec have the fewest restrictions. Check the rules for the specific area you want to buy in.

- You will likely need a work permit or visitor visa to buy a house. You can’t just travel to Canada and purchase a home as a tourist.

- You’ll need a Social Insurance Number (SIN) to work or buy property in Canada. Apply for one before purchasing.

- Mortgage rates for nonresidents are typically higher than for Canadian residents. Some banks may not lend to nonresidents at all.

- There may be additional legal fees when purchasing as a nonresident. Hire a Canadian real estate lawyer to handle the transaction.

- You’ll need a Canadian bank account to pay utilities, property tax, and your mortgage (if you get one).

- Any capital gains from selling the property will be taxed in both the U.S. and Canada. You’ll need to file taxes in both countries.

- Some municipalities have limits on the percentage of homes that nonresidents can own. Check local rules.

- When you eventually sell the property, you may need to withhold up to 25% of the sale proceeds and remit it to the Canada Revenue Agency (CRA) as a nonresident tax.

Is it hard for a U.S. citizen to buy property in Canada?

Buying property in Canada as a U.S. citizen can be challenging for a few reasons:

Financing – Getting a mortgage in Canada as a nonresident is difficult. Many lenders will not give mortgages to foreigners, and those that do typically charge higher interest rates.

Taxes – You’ll have to pay Canadian and U.S. property taxes. This includes capital gains taxes when you eventually sell. Figuring out the tax implications can be complex.

Visa requirements – You’ll need a visa to purchase property in Canada, either a work permit or a visitor visa. You can’t just travel there as a tourist to buy a home.

Legal fees – Hiring a Canadian real estate lawyer can add to your transaction costs.

Banking – You’ll need a Canadian bank account to manage utilities, property taxes, and a potential mortgage.

Additional paperwork – You must apply for a Social Insurance Number (SIN) to buy property in Canada. This adds administrative steps.

Homeowner insurance – Insurance for nonresident property owners can be more expensive and harder to obtain.

Property management – If you don’t plan to live in the property full time, you’ll need to hire someone to manage it when you’re away.

Currency risk – Currency fluctuations between Canadian and U.S. dollars pose an added risk for foreign buyers.

Regulations – Some provinces have tightened rules around foreign home ownership in recent years.

With planning and the proper support, U.S. citizens can purchase property in Canada successfully. But it does require extra effort and due diligence.

FAQs

Can I buy a property in Canada without being a resident?

Yes, you can buy a property in Canada as a nonresident. However, you may need to pay additional taxes and fees.

How much does it cost to buy a property in Canada?

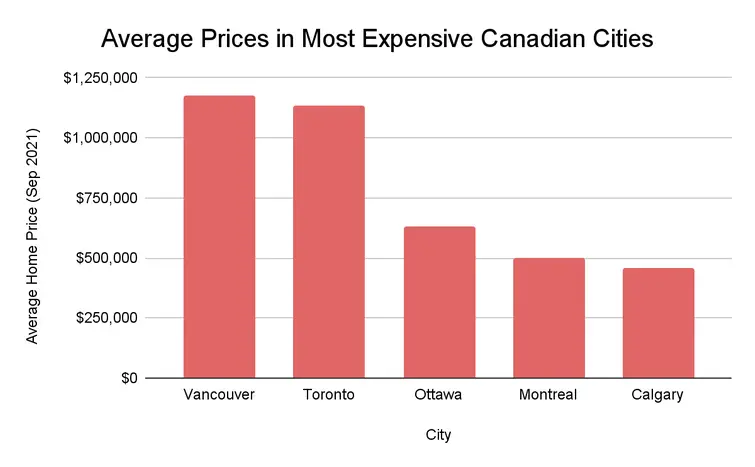

The cost of buying a property in Canada varies depending on the region and the property type. You can expect to pay anywhere from $200,000 to $1 million or more.

Can I rent out my property in Canada?

Yes, you can rent out your property in Canada. However, you will need to pay income taxes on any rental mustard.

How long does it take to buy a property in Canada?

The time it takes to buy a property in Canada can vary. It usually takes between 30 to 90 days to complete the buying process.

Can I get a mortgage in Canada as a U.S. citizen?

Yes, you can get a mortgage in Canada as a U.S. citizen. However, you may need to provide additional documentation, such as income, credit history, and rental income.

Can Us Citizen Buy Property in Mexico?

Conclusion

Buying a property in Canada as a U.S. citizen is possible, but it requires some research and preparation. You should familiarize yourself with the Canadian real estate market, get financing, be aware of taxes, and hire a real estate agent before making any purchases.