How to Buy a Multifamily Property With No Money Down?

What is a Multifamily Property?

Before we dive into the details of how to buy a multifamily property with no money down, let’s first define what a multifamily property is.

A multifamily property is a residential property that contains more than one unit. This can include duplexes, triplexes, fourplexes, and apartment buildings.

Investing in a multifamily property can be a great way to generate passive income and build wealth over time.

Finding the Right Property

The first step to buying a multifamily property with no money is to find the right one.

This can be done by searching online, working with a real estate agent, or driving around neighborhoods that you are interested in.

When looking for a multifamily property, it’s essential to consider factors such as location, condition, and potential rental income.

Partnering with Investors

One way to buy a multifamily property with no money is to partner with investors.

This can be done by finding investors willing to provide the funds needed for the down payment in exchange for a percentage of the profits.

When partnering with investors, having a solid business plan and clearly defining each party’s roles and responsibilities is essential.

Using Creative Financing Options

Another way to buy a multifamily property with no money is to use creative financing options.

This can include seller financing, lease options, and private money loans. Seller financing involves the seller of the property providing the financing for the purchase.

Lease options involve renting the property with the option to buy later. Private money loans involve borrowing funds from private individuals or companies.

Negotiating with the Seller

When buying a multifamily property with no money down, it’s essential to negotiate with the seller to get the best possible deal.

This can include negotiating the purchase price, the terms of the financing, and any repairs or upgrades that need to be made to the property.

It’s essential to approach negotiations with a clear understanding of your goals and to be willing to walk away if the deal doesn’t meet your needs.

How to Buy a Multifamily Property With Low-Income?

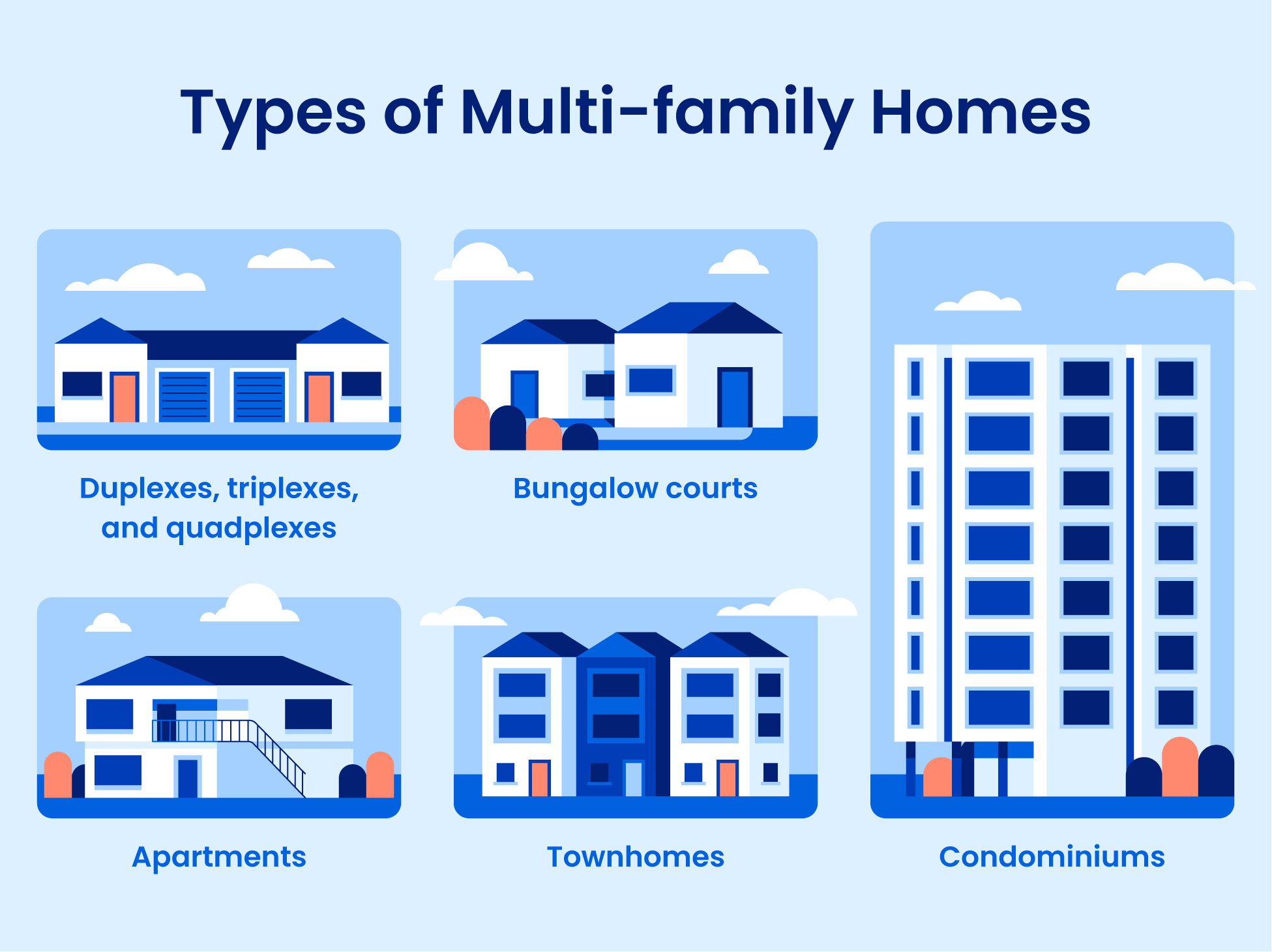

Types of Multifamily Houses

Here are the main types of multifamily houses:

• Apartment buildings: These are the largest multifamily dwellings with multiple units stacked on each other. They can range from 3 to 30+ stories tall and have hundreds of units. Apartment buildings typically have shared entrances, hallways, amenities, and utilities.

• Townhouses: Also known as row houses, townhouses are attached units arranged side by side. They typically have private entrances and yards and share walls with adjacent units. Townhouses tend to be 2 to 4 stories tall and have 3 to 12 units in a row.

• Condominiums: Condos are similar to apartments in that they are stacked units, but residents own their units rather than renting. There is an owners association that maintains common areas and the exterior of the building. Condos can be in low-rise or high-rise buildings.

• Duplexes/triplexes: These are smaller multifamily dwellings with 2 or 3 side-by-side or stacked units. They tend to be single-family homes subdivided into 2 or 3 units. Each unit usually has its own entrance, yard space, and utilities.

• Garden apartments: are low-rise apartments, usually 2 or 3 stories tall. They resemble a cluster of large houses rather than tall apartment buildings. Units typically have more space and privacy, and the complex has landscaped common areas.

Tips for buying multifamily houses:

Research the market – Find out what rental rates are like in the area for units similar to the ones you are considering. Understand the demand and vacancy rates. This will help you determine the property’s cash flow potential.

Get financing in order – Most lenders view multifamily properties as investments and will require at least 25% down. Some offer specialized loans for these types of properties. Get pre-approved before making an offer.

Inspect thoroughly – Hire an inspector who is experienced with multifamily properties. They will check HVAC, electrical, plumbing, roof, foundation, and structural issues. Repairs can be costly.

Calculate cash flow – Use an online calculator to determine the property’s cash flow based on rental income, mortgage payment, taxes, insurance, utilities, management fees, vacancies, and maintenance costs. Aim for positive cash flow.

Consider property management – Larger properties require a property manager to handle rent collection, maintenance, tenant issues, etc. Costs can range from 6% to 12% of rental income. Decide if you want to manage it yourself.

Interview current tenants – Talk to existing tenants to understand any issues and gauge their satisfaction. Take note of any warning signs like frequent lease breakouts or complaints. High tenant turnover can be costly.

Search for deals – Properties that need improvements are cheaper but have higher risks. Rehab costs can quickly wipe out any savings. Look for good value relative to income potential.

Check HOA and zoning rules – Make sure the property complies with any homeowner association or zoning regulations that restrict use as a rental property. Get this in writing before purchasing.

FAQs

What are some creative financing options for buying a multifamily property?

Some creative financing options for buying a multifamily property include seller financing, lease options, and private money loans.

How can I find investors to partner with for a multifamily property purchase?

You can find investors to partner with by networking with other real estate professionals, attending real estate events, and using online platforms such as LinkedIn and BiggerPockets.

What factors should I consider when choosing a multifamily property to invest in?

When choosing a multifamily property to invest in, it’s essential to consider factors such as location, condition, potential rental income, and the potential for value appreciation.

How can I negotiate with the seller to get the best deal on a multifamily property?

To negotiate with the seller to get the best deal on a multifamily property, it’s essential to approach negotiations with a clear understanding of your goals and to be willing to walk away if the deal doesn’t meet your needs.

Is it possible to buy a multifamily property with no money down?

Yes, buying a multifamily property with no money down is possible by partnering with investors, using creative financing options, and negotiating with the seller.

Conclusion

Buying a multifamily property with no money down is possible, but it requires creativity, persistence, and a willingness to take calculated risks.

By partnering with investors, using creative financing options, and negotiating with the seller, you can achieve your dream of owning a multifamily property and building long-term wealth.