How to Buy Property in Canada?

Are you thinking about buying property in Canada? It can be an exciting and potentially profitable venture.

It can also be overwhelming if you’re not prepared.

I’ve compiled this guide to help you navigate buying property in Canada.

Keep reading to learn everything you need to know.

Buying property in Canada can be a significant investment, whether you want to own a vacation home or generate rental income.

It’s essential to research and understand the process before diving in.

Consider your budget, choose a location, find a real estate agent, get pre-approved for a mortgage, make an offer, hire a lawyer, and close the deal.

Consider Your Budget

Before you start looking at properties, it’s essential to consider your budget.

This will help you determine what you can afford and what property type you should seek. Take into account your income, savings, and any existing debt.

Consider the down payment, closing costs, and ongoing expenses such as property taxes and maintenance.

Choose a Location

Once you have a budget, it’s time to choose a location. Canada is a large country with a diverse range of landscapes and climates.

Think about what type of property you’re looking for and what amenities you want nearby. Do you want to be close to the mountains for skiing or near the beach for swimming?

Do you want to be in a bustling city or a more rural area?

Find a Real Estate Agent

A real estate agent can be a valuable asset when buying property in Canada.

They can help you find properties that fit your criteria, negotiate with sellers, and guide you through buying.

Look for an agent who specializes in the area you’re interested in and has experience working with international buyers.

Get Pre-Approved for a Mortgage

Getting pre-approved for a mortgage is essential before you start making offers on properties.

This will give you a better idea of what you can afford and make you a more attractive buyer.

Shop for the best rates and terms, and consider working with a mortgage broker to help you find the right lender.

Make an Offer

Once you find a property you’re interested in, it’s time to make an offer. Your real estate agent will help you draft a purchase agreement outlining the sale terms.

This will include the purchase price, closing date, and any conditions, such as a home inspection or financing contingency. Be prepared to negotiate with the seller if necessary.

Hire a Lawyer

Before closing the deal, hiring a lawyer to review the purchase agreement and ensure everything is in order is essential.

They can also help you navigate any legal issues arising during buying.

Look for a lawyer specializing in real estate law who has experience working with international buyers.

Close the Deal

Once everything is in order, it’s time to close the deal. This involves signing the purchase agreement, transferring funds, and registering the property in your name.

Your lawyer and real estate agent will guide you through this process and ensure everything is done correctly.

Can foreigners buy property in Canada?

Yes, foreigners can buy property in Canada, subject to some restrictions. Here are the main points:

Non-resident foreigners can purchase residential property in Canada, including single-family homes, condos, and vacation properties. There are no quotas or limits on the number of properties they can buy.

Depending on the province, foreign buyers must pay a 0.5% to 20% tax. For example, in British Columbia, foreign buyers pay a 20% surtax on property purchases.

There are some restrictions on agricultural land and properties close to military bases. Foreigners may need approval from the Canadian government to buy such properties.

Foreign-owned companies can also purchase commercial real estates in Canada, like office buildings, retail spaces, and industrial properties.

Foreign investors may qualify for faster residency through investment immigration programs. This would allow them to purchase property as a Canadian resident.

To complete a property purchase in Canada, foreigners must work with a real estate agent and a lawyer familiar with transactions involving non-resident buyers. Mortgages may also be more challenging to obtain as a non-resident.

So, in summary, yes, foreigners can buy real estate in Canada, but there are some taxes, restrictions, and extra steps involved compared to Canadian residents. The process tends to be most straightforward for cash buyers purchasing residential properties.

Can I get PR if I buy property in Canada?

Buying property in Canada alone does not qualify you for permanent residency (PR). Some investment immigration programs allow you to prepare for PR through investing and owning a business in Canada, but simply buying a house or condo would not be sufficient.

To qualify for PR through investment and business, programs like the Investor Immigrant program and Entrepreneur stream require:

- Significant investment amounts (hundreds of thousands of dollars)

- Intent to actively manage the investment or business

- Evidence of net worth and funds

- We meet minimum eligibility criteria like age, language ability, education, etc.

- Simply purchasing a property would not meet the requirements of these programs.

You would generally need to:

- Make a significant cash investment

- Invest in and actively manage an existing Canadian business

- Start a new, viable Canadian business that creates jobs for Canadian residents

Property ownership can be considered a “soft” factor to strengthen an investment immigration application, but it is insufficient. I hope this overview helps clarify things! Let me know if you have any other questions.

How much money is required to buy a house in Canada?

No set amount of money is required to buy a house in Canada. However, as a general guide:

- At a minimum, you’ll need a sizable down payment, usually between 5% and 20% of the purchase price. For example, for a $500,000 home, you’d need between $25,000 to $100,000 as a down payment.

- You’ll also need enough money to cover closing costs, which typically run between 2% to 5% of the purchase price. So for a $500,000 home, closing costs could be $10,000 to $25,000.

- To qualify for a mortgage, most banks require that your total debt costs (including mortgage payments, property taxes, and utilities) not exceed around 32% to 39% of your gross monthly income. So the more income you have, the larger mortgage you can qualify for.

- For higher-priced homes, like those over $1 million, most lenders require a minimum down payment of 20% and often have stricter qualifying criteria.

- If you’re a newcomer to Canada or have a poor credit history, you may need an even more significant down payment (30% or higher) and co-signer to qualify for a mortgage.

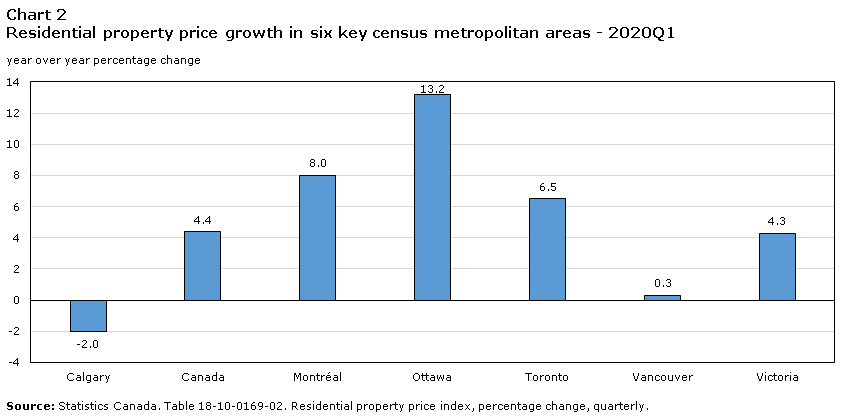

Home prices and costs vary significantly by region in Canada. Cities like Vancouver and Toronto generally have the highest house prices, often over $1 million, even for townhomes and condos.

Brokerage Rates In Canada

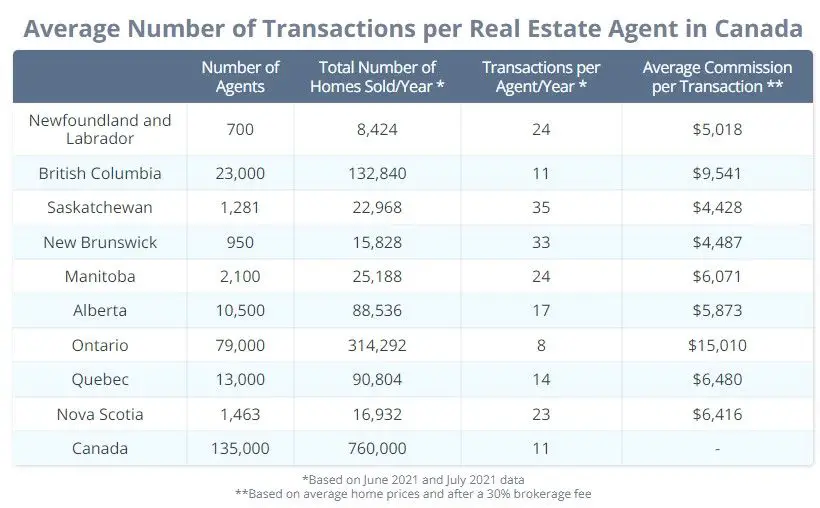

Here are the typical brokerage rates you can expect in Canada:

Full-service brokerages: Around 2.5%-3% commission on the sale price. These brokerages offer various services like staging, photography, open houses, negotiating, etc.

Discount brokerages: Around 1.5%-2% commission. These brokerages typically offer less support but at a lower cost.

Flat fee/retainer listings: Around $5,000-$15,000 flat rate. You pay a fixed fee and handle more of the work yourself.

For buyers, brokerages generally charge a commission between 1%-2.5% based on the purchase price. The seller pays for this.

For example:

A $500,000 home sale through a full-service brokerage would incur around $15,000 ($500,000 x 3%) in commission fees for the seller.

The same home sale through a discount brokerage could cost around $10,000 ($500,000 x 2%) in commission fees.

A flat fee listing for the $500,000 home may cost the seller a $10,000 flat fee instead of a percentage commission.

So, in general, you have options in Canada ranging from full-service brokerages charging the highest commission rates to discount or flat-fee brokerages charging less but requiring more work.

The overall commission rates are standard nationwide, though the services provided vary.

Full-service brokerages may provide the most value for their slightly higher commission rates if you’re selling a high-priced home or in a very competitive market.

But discount or flat-fee options can save you money for more short sales.

FAQs

What taxes do I need to pay when buying property in Canada?

When buying property in Canada, you must pay a land transfer tax and a goods and services tax (GST) or harmonized sales tax (HST), depending on the province.

There may also be property taxes and other fees to consider.

Can I get a mortgage as an international buyer?

Yes, it’s possible to get a mortgage as an international buyer.

The requirements may be different than for Canadian citizens and permanent residents.

You may need a larger down payment and a good credit history.

Do I need to be present in Canada to buy a property?

No, you don’t need to be present in Canada to buy property.

Working with a real estate agent and lawyer who can represent you and ensure everything is done correctly is essential.

Can I rent out my property in Canada?

Yes, you can rent out your property in Canada. However, you must follow local laws and regulations regarding landlord-tenant relationships and rental income taxes.

How long does it take to buy property in Canada?

The timeline for buying property in Canada can vary depending on the location, property type, and other factors. It can take a few weeks to several months to complete the process.

How to Buy Adjudicated Property?

Conclusion

Buying property in Canada can be a significant investment, but it’s essential to research and understand the process before diving in.

Consider your budget, choose a location, find a real estate agent, get pre-approved for a mortgage, make an offer, hire a lawyer, and close the deal.

With these steps in mind, you can navigate the process with confidence and find the perfect property for your needs.

Stay informed about local laws and regulations and work with experienced professionals who can guide you.

With a little bit of preparation and patience, you can make your dream of owning property in Canada a reality.