How to Buy Rental Property with LLC?

Are you considering using an LLC to purchase a rental property?

If so, you are in the proper location. Limited liability companies, or LLCs, are frequently used by real estate investors to buy rental properties.

Doing this can shield their assets from any potential risks of owning rental property.

The steps you can take to purchase a rental property with an LLC are covered in this article.

Steps to buying rental property with LLC

- Choose a name for your LLC

Your LLC should have a name that is both original and not in use by another LLC in your state. The state’s business entity database can be searched to see if a name is available. You must specify the word in your articles of organization once you’ve decided. - File articles of organization with the state

The legal documents known as articles of organization make your LLC a legitimate business in the state. The names of the LLC’s members, the registered agent’s name and address, and the name of the LLC are typically included. These articles must be submitted along with a filing fee to the state’s secretary of state office. - Obtain an EIN from the IRS

An employer identification number, or EIN, is a unique nine-digit number the IRS has given to your LLC. It is necessary to open a business bank account, which is used for tax purposes. On the IRS website, you can submit an online EIN application. - Open a business bank account.

Once you have obtained an EIN, you can open a business bank account for your LLC. This will help keep your personal and business finances separate, which is essential for liability protection and tax purposes. - Obtain financing for the rental property.

You’ll probably need financing to buy a rental property. A traditional bank loan, a mortgage broker, or a private lender are all options for financing this. Use the name and EIN of your LLC when submitting a financing application. - Purchase the rental property with the LLC.

Once you have obtained financing, you can purchase the rental property with your LLC. The LLC will own the property, not you personally, which provides liability protection.

Managing the rental property with an LLC

- Collect rent payments through the LLC

You should collect rent payments through the LLC to further protect your personal assets. This will help ensure that any liabilities related to the rental property remain with the LLC and do not affect your finances. - Maintain separate financial records for the LLC.

Bank statements, tax returns, and accounting records should all be kept separately for your LLC’s finances. This will assist you in maintaining organization and supplying proof in the event of an audit. - Comply with state and local laws and regulations.

As a rental property owner, you will be responsible for complying with state and local laws and regulations. This includes obtaining any necessary licenses or permits, following fair housing laws, and maintaining the property safely and habitable.

How to Buy Property in the Metaverse?

What are the tax benefits of using an LLC to buy a rental property?

There are a few main tax benefits of using an LLC to buy rental property:

Tax Deductible Losses – An LLC may record a loss on its taxes if its rental income for a given year is less than its expenses. The LLC members can then use the loss to offset other income and lower taxes due. If you owned the property, this would not be possible.

Depreciation Deductions – The LLC is eligible to deduct the cost of any improvements made to the rental property and their depreciation. As a result, the rental activity’s taxable income that is carried over to the LLC members’ tax returns may be significantly reduced.

Lower Capital Gains Taxes – Any capital gains will be taxed at the typically lower corporate capital gains tax rate rather than the higher personal capital gains tax rate when the LLC eventually sells the rental property. The LLC members then receive the gains.

Advantage of Self-Employment Taxes – The LLC members pay self-employment taxes on their portion of the net income of the LLC. However, mortgage interest, real estate taxes, repairs, and maintenance costs can lower that net income and the amount of self-employment taxes due.

Benefits for Estate Taxes – Since LLC interests are worth less than personal property ownership interests, the property may not be included in an LLC member’s taxable estate. Taxes on estates may be avoided as a result.

What are the requirements for forming an LLC?

The main requirements for forming an LLC vary by state but generally include the following:

• Choose a name – The LLC name must be unique and distinguishable from other businesses in that state. Some states have naming requirements to include LLC, Ltd, or Limited.

• File formation documents include the LLC’s name, registered agent and address, purpose, members’ names, and more. You’ll typically file articles of organization with the state.

• Create an operating agreement – This specifies how the LLC will be managed, decisions made, profits distributed, members added or removed, and how the LLC will eventually dissolve. It governs the internal rules.

• Obtain an Employer Identification Number (EIN) – The IRS requires all LLCs to obtain an EIN, even single-member LLCs. It’s used for payroll taxes, income taxes, and opening business bank accounts.

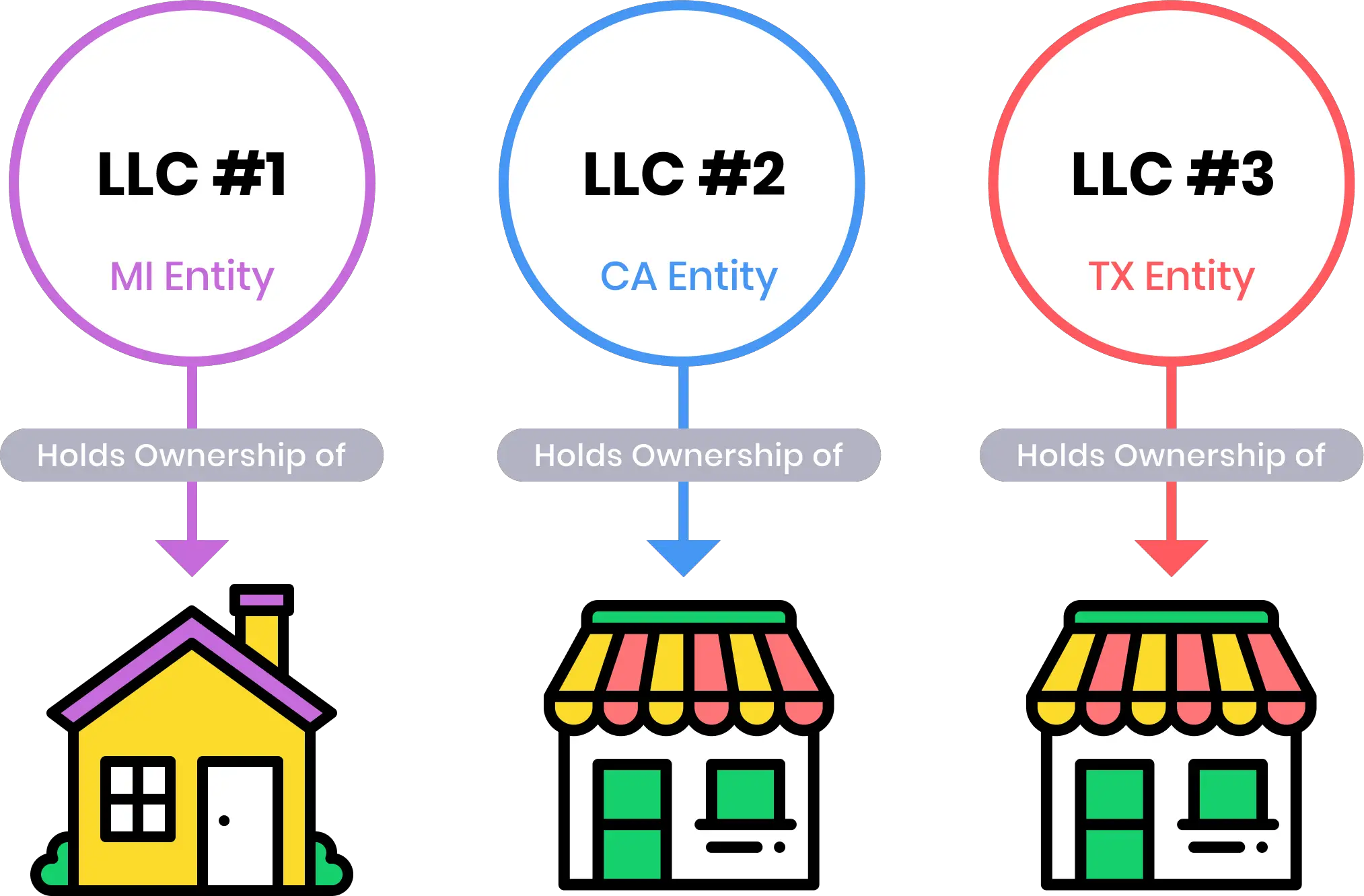

• Register as a “foreign entity” – If your LLC operates in a state different from where it was formed, you’ll need to register it as a foreign entity in that other state.

• Designate a registered agent – The LLC must have a registered agent and registered office address on file with the state to receive official documents and notices.

• Open a business bank account – Most banks will require the articles of organization and EIN to open an account for an LLC.

• Pay annual fees – States typically charge an LLC formation fee and yearly report/statement filing fee to maintain the entity’s status.

Those are the main requirements, though requirements do vary by state. Formation usually takes 1-2 weeks after filing all required documents and paying fees. Then you can start operating as an LLC.

What are the pros and cons of using an LLC for rental property?

Here are the main pros and cons of using an LLC for rental property:

Pros:

• Liability protection – The main advantage is that an LLC protects your assets if a tenant sues you. The LLC’s assets are separate.

• Tax benefits – LLCs allow for tax deductions like depreciation, losses, and lower capital gains taxes, as outlined in my previous response.

• Easier property management – Handling the rental through an LLC keeps finances and records separate from your personal affairs.

• Potential ease of financing – Some lenders may offer better rates or terms to an LLC vs. an individual.

• Estate tax benefits – LLC ownership may reduce the taxable value of the property in your estate.

Cons:

• Higher costs – There are formation costs for an LLC and additional yearly maintenance fees.

• Additional paperwork – Managing an LLC requires tax filings, annual reports, and other legal documents that individuals don’t need.

• Mortgage challenges – Some lenders still require personal guarantees or recourse loans for LLCs.

• Potential complications – Transferring or removing LLC members can become complex.

• Less privacy – LLC records are public, so your property ownership is not entirely private.

• Loss of step-up in basis – With personal ownership, heirs get a “step-up” in tax basis upon inheritance. LLCs don’t qualify for this.

What are the annual fees for maintaining an LLC?

There are a few main types of annual fees involved in maintaining an LLC:

State Filing Fees – Most states charge an initial LLC formation fee, usually around $100 to $500. They also charge an annual fee (often $100 or less) to file the LLC’s annual report and maintain the LLC in “good standing.”

Accounting and Tax Prep Fees – LLCs must file Schedule C tax forms to report business income and expenses. Depending on the complexity, professional tax prep, and accounting fees can range from $200 to $1,000 per year,

Registered Agent Fees – Most states require LLCs to maintain a registered agent to receive official documents. This service typically costs $50 to $200 per year.

Business License Fees – Some cities and counties require LLCs to obtain a general business license, usually costing under $100 annually. Rental LLCs may have additional license fees.

Legal Fees – LLCs occasionally incur nominal legal fees to handle things like updating operating agreements, transferring ownership, or responding to legal notices.

So the minimum annual fees for an essential LLC with no complications are typically around $250 to $500 annually. This includes the yearly state filing fee, registered agent fee, and basic accounting and tax prep.

What are the consequences of not maintaining an LLC in good standing?

Here are some of the consequences of not maintaining an LLC in good standing:

• Loss of limited liability protection – The main benefit of an LLC is liability protection. But if the LLC is not in good standing, courts may “pierce the corporate veil” and hold the owners personally liable.

• Inability to file lawsuits – Most states do not allow LLCs that are not in good standing to file lawsuits or take legal action against others.

• Contracts may be voided – The other parties could cancel any contracts the LLC enters into during this time.

• Tax issues – The IRS and state tax agencies may deny tax benefits and deductions claimed by LLCs that are not in good standing. Additional penalties may apply.

• Bank account issues – Banks may freeze or close the LLC’s account until it is restored to good standing.

• Revocation of LLC status – The state may ultimately revoke the LLC’s status and terminate it if annual filings and fees are severely delinquent. The owners would then be personally liable for all LLC debts and obligations.

• Fines and penalties – Most states charge late fees and penalties for failing to file annual reports and pay filing fees on time. These can accumulate quickly.

• Inability to sell or transfer assets – LLCs not in good standing generally cannot legally sell assets or membership interests until they are brought current.

FAQs

What is an LLC?

An LLC, or limited liability company, is a type of business structure that provides liability protection for its owners. It is a popular choice for real estate investors because it can help protect personal assets from any potential liabilities from owning rental property.

Why should I use an LLC to purchase a rental property?

Using an LLC to purchase rental property can provide liability protection for your assets. If any lawsuits or claims arise related to the rental property, your assets will be protected if the LLC is properly structured and managed.

What is an EIN?

An EIN, or employer identification number, is a unique nine-digit number assigned to your LLC by the IRS. It is used for tax purposes and is required to open a business bank account. It also identifies your LLC for tax filings and other legal purposes.

Can I get financing for a rental property with an LLC?

Yes, you can get financing for a rental property with an LLC. You can apply for a traditional bank loan, work with a mortgage broker, or seek funding from a private lender. When applying for financing, use your LLC’s name and EIN.

Do I need to hire a property management company to manage the rental property?

The management of the rental property does not require the hiring of a property management firm. However, hiring a property management company can be a good choice if you lack the necessary skills or time to manage the property yourself. They can handle chores like tenant vetting, rent collection, and maintenance, making it easier to manage to own a rental property.