How to Buy Tax-Delinquent Property?

Buying a tax-delinquent property can be an excellent investment in real estate. The process can seem overwhelming, but it can be a lucrative investment opportunity with the proper knowledge and approach.

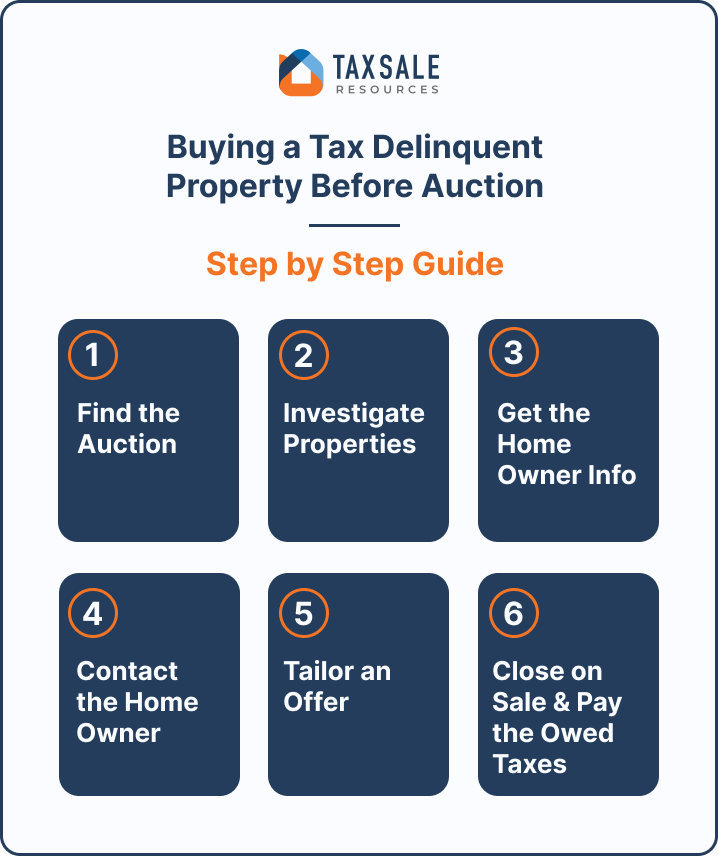

In this article, we will go over how to buy tax-delinquent property step by step.

What is a tax-delinquent property?

A tax-delinquent property is a property whose owner has failed to pay property taxes for a specific period.

The government can place a lien on the property, giving them the right to sell it to collect the unpaid taxes. Tax-delinquent properties can be residential, commercial, or vacant land. These properties are typically sold at a tax sale auction.

How does the tax-delinquent property auction work?

The tax-delinquent property auction is a public sale held by the county or city government to sell properties with unpaid property taxes. These auctions take place once or twice a year. The auction is open to the public; anyone can bid on the properties. The starting bid is usually the amount of unpaid taxes plus any fees and interest.

Research the property.

Before you attend the auction, it is essential to research the property you are interested in. You should gather information about the property, such as its location, size, and condition. You should also find out if there are any liens or other debts on the property. This information can be obtained from the county or city government.

Attend the auction

Once you have researched, you are ready to attend the auction. The auction will be held at a specific location on a particular date and time. It would be best to arrive early to register and get a bidder number. You should also bring a cashier’s check or cash to cover the deposit and other fees.

The bidding process

The bidding process can be competitive, so it is essential to have a strategy in place. You should set a budget for the property and stick to it. You should also be prepared to leave if the bidding goes too high. Remember, the starting bid is usually the amount of unpaid taxes plus any fees and interest.

After winning the auction

If you are the highest bidder, you must pay the purchase price balance within a specified timeframe. You must also pay any outstanding taxes, fees, and interest. Once you have paid in full, you will receive a deed to the property.

What is the best state to buy tax lien certificates?

There are a few states that are generally considered suitable for buying tax lien certificates based on factors like:

• High-interest rates – States that offer higher interest rates (10% to 18% or more) on tax liens tend to be more attractive to investors. This includes states like New Jersey, Florida, Pennsylvania, and Michigan.

• Low redemption rates – States where a lower percentage of property owners redeem their tax liens, allowing more to go to foreclosure. This means a higher chance of the investor obtaining the property.

• Strong economy – States with lower unemployment, higher incomes, and property values tend to have lower tax lien redemption rates, making them better investor bets. This includes states like California, Texas, and New York.

• Limited or no tax lien pools – Some states allow all eligible tax liens to be purchased, not just those for auction. This opens more opportunities for investors. States like Florida, New Jersey, and Hawaii work this way.

• Less competition – States with fewer tax lien investors generally have more availability of liens to purchase and less competition driving up prices. Lesser-known states can be good opportunities.

• Strong real estate market – If the goal is obtaining the property through tax deed sale, states with high demand for real estate and a stable market are preferable. This includes conditions like Texas, California, Florida, and Arizona.

How to Buy Out a Sibling on Shared Property?

How long can you go without paying property taxes in TN?

In Tennessee, there are consequences for not paying property taxes on time, but property owners generally have a few years before facing foreclosure. Here’s how it works:

• Property taxes are typically due by March 1 each year in Tennessee. There is a 6-month grace period until September 1 before penalties begin accruing.

• After September 1, the property owner will begin incurring penalty fees of 1.5% per month on unpaid taxes. These penalties continue to accrue monthly until the taxes are paid in full.

• If the taxes remain unpaid by the end of the year (December 31), the county register of deeds places a tax lien on the property. This creates a legal claim on the property for unpaid taxes.

• After two years of delinquent taxes (two years past the March 1 due date), the county may initiate foreclosure proceedings to recover the unpaid taxes and penalties. This involves filing a lawsuit in chancery court.

• If the property owner does not pay the back taxes, penalties, and legal fees during the foreclosure proceeding, the county can obtain a court order to sell the property at a tax sale to recover the amount owed.

• Once foreclosure proceedings have begun, the property owner generally has six months to a year to pay the owed amount before the tax sale occurs and ownership changes hands.

How do I buy tax-delinquent property in Texas?

Here are the main steps to buy tax-delinquent property in Texas:

Find eligible properties. Check county tax assessor records for properties that are delinquent on property taxes. The county tax collector should have a list of properties suitable for tax sales.

Do your due diligence. Research the property, check for liens and encumbrances, and verify that there are no issues that would prevent you from obtaining a clear title after the tax sale.

Review tax amount owed. Determine how much back taxes, penalties, and fees are owed on the property. You’ll likely need to pay this in full to purchase the property at the tax sale.

Attend the tax sale auction. Texas conducts tax sales via public auction. Register with the county tax collector’s office and bid on the properties you want to purchase.

Outbid other buyers. Properties are sold to the buyer offering the lowest interest rate they will accept on the back taxes owed. You’ll need to outbid other tax lien investors to purchase the property.

Obtain a tax deed/certificate. Once you are the successful bidder, pay the amount owed in total, and the county will issue you a property tax deed or certificate of sale.

Wait out the redemption period. In Texas, property owners have up to 2 years after the tax sale to redeem their property by repaying the back taxes, interest, and fees. If unredeemed, you will obtain a clear title.

Obtain a fee simple title. After the redemption period expires without payment from the owner, you can apply for and be granted a fee simple title to the property by the county. The previous owner’s rights will be extinguished.

FAQs

What happens if the property is not sold at auction?

If the property is not sold at auction, it will become a part of the government’s inventory of tax-delinquent properties. These properties may be sold at a later date.

Can I inspect the property before the auction?

In most cases, you can inspect the property before the auction. You should contact the county or city government to schedule an inspection.

Can I finance the purchase of a tax-delinquent property?

In most cases, financing is not available for tax-delinquent properties. You will need to pay in cash or with a cashier’s check.

What happens if the property has other liens or debts?

If the property has other liens or debts, you will be responsible for paying them and the unpaid taxes.

Can I sell the property after I purchase it?

Yes, you can sell the property after you purchase it. However, you must pay outstanding taxes, fees, and interest before transferring the deed to the new owner.

Conclusion

Buying a tax-delinquent property can be a great investment opportunity if you research and approach the process with a strategy.

It is important to remember that the operation can be competitive, so it is essential to have a budget and be prepared to walk away if the bidding goes too high.