How to Use Equity to Buy Investment Property?

Are you looking to invest in real estate but don’t have enough cash to purchase?

One option is to use equity from existing property to buy an investment property.

This article will explore the steps you need to take to use equity to buy an investment property.

What is Equity?

Equity is the difference between the current market value of a property and any outstanding mortgage or liens on the property.

For example, if your property is worth $500,000 and you owe $300,000 on your mortgage, you have $200,000 in equity.

What is usable equity?

Usable equity is the portion of your home’s equity you can access for things like a home equity loan or line of credit (HELOC). It’s different from your total equity in the property.

Your total equity is the difference between your home’s market value and mortgage balance.

So if your home is worth $300,000 and you have a $200,000 mortgage, your total equity is $100,000.

Your total equity may not be usable. Lenders typically only allow you to access up to 80-85% of your total equity while leaving enough “cushion” in case home values drop.

So in the example above, with $100,000 in total equity, your usable equity would likely be around $80,000 to $85,000.

Lenders want to maintain a loan-to-value ratio (LTV) of less than 85% for HELOCs and home equity loans.

Some of the main reasons you may want to access your usable equity could be:

- Home renovations or improvements

- Debt consolidation

- Investment purposes

- College tuition and expenses

- Major purchases

Usable equity refers to the portion of your total home equity available to you via a loan while keeping an adequate LTV ratio.

This ensures lenders maintain some cushion in case of falling home values.

Benefits of Using Equity to Buy Investment Property

Using equity to buy an investment property has several advantages.

- It lets you purchase a property without liquidating other assets or generating a sizeable down payment.

- It can help you build wealth by leveraging the equity in your existing property.

- If done correctly, it can lead to a steady stream of passive income from rental income.

Determine the Equity

Before you can use equity to buy an investment property, you must determine how much equity you have in your existing property.

There are two ways to calculate the property’s equity and the maximum loan amount.

Calculate the Property’s Equity

To calculate the property’s equity, subtract the outstanding mortgage balance from the property’s current market value.

For example, if your property is worth $500,000 and you owe $300,000 on your mortgage, you have $200,000 in equity.

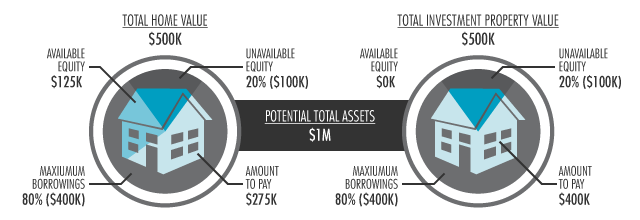

Calculate the Maximum Loan Amount

The maximum loan amount is the amount a lender is willing to lend you based on the equity you have in your property.

Most lenders require a maximum loan-to-value (LTV) ratio of 80%, meaning you can borrow up to 80% of the value of your property.

To calculate the maximum loan amount, multiply the property’s value by the maximum LTV ratio.

For example, if your property is worth $500,000 and the maximum LTV ratio is 80%, the maximum loan amount would be $400,000.

Apply for a Loan

Once you have determined how much equity you have in your property and the maximum loan amount you can borrow, you can apply for a loan.

Several types of loans are available for investment properties, including conventional loans, FHA loans, and hard money loans.

Conventional Loans

Conventional loans are the most common type of loan for investment properties.

Banks and other financial institutions offer these loans with the most favorable terms and interest rates.

FHA Loans

FHA loans are government-backed loans available to individuals with lower credit scores and income levels.

These loans have more lenient credit and income requirements but require a higher down payment.

Hard Money Loans

Hard money loans are short-term loans that private lenders offer.

These loans have higher interest rates and fees but can be a good option if you need to close quickly or have poor credit.

To apply for a loan, you must provide the lender with your financial information, including your income, credit score, and debt-to-income ratio.

You may also need to document your existing property’s value and equity.

Purchase the Investment Property

Once approved for a loan, you can start looking for an investment property.

Consider location, price, and potential rental income when looking for a property.

Once you have found a property, you will need to make an offer and negotiate the terms of the sale.

Find the Property

There are several ways to find an investment property, including working with a real estate agent, attending auctions, and searching online listings.

Make an Offer

When making an offer on a property, consider the property’s condition, potential rental income, and the seller’s asking price.

Be prepared to negotiate the terms of the sale, including the purchase price, closing costs, and any repairs or renovations needed.

Close on the Property

Once you have agreed to the terms of the sale, you will need to close on the property. This involves signing the necessary paperwork and transferring ownership of the property to you.

Manage the Investment Property

Once you have purchased the investment property, you must manage it. This includes finding and screening tenants, collecting rent, and maintaining the property.

Consider hiring a property management company if you do not have the time or expertise to manage the property yourself.

Property Management

Property management involves ensuring the property is in good condition, handling tenant complaints, and collecting rent.

A property management company can handle these tasks, ensuring the property is well-maintained and profitable.

Tenant Screening

Tenant screening is an essential part of managing an investment property.

It involves reviewing tenant applications, conducting background checks, and verifying income and employment.

Proper tenant screening can help avoid problem tenants and ensure a steady rental income stream.

Tips for investing in property

Here are some suggestions for investing in property:

Do your research. Understand the property market, returns, risks, and costs involved. Look at historical data for the specific area you’re considering.

Get financing in order. Make sure you have the funds or financing secured before making an offer. Get pre-approved for a mortgage if needed.

Buy for cash flow, not just appreciation. Focus on properties that will generate positive cash flow from rent to cover expenses and give you a return.

Consider non-residential properties like commercial or industrial. They often have higher yields than residential properties.

Look for undervalued properties or those needing renovation. These can give you opportunities for higher returns.

Diversify your portfolio. Don’t put all your property investments in one area or location. Spread your risk.

Automate management tasks. Use tools and apps to manage rent collection, expenses, maintenance requests, etc.

Outsource repairs and maintenance. Hire contractors to handle fixes, repairs, and upgrades so you don’t have to deal with them yourself.

Have reserves. Keep aside a few months of expenses to cover maintenance, repairs, and vacancy periods.

Use leverage carefully. While power can increase returns, it also increases risk. Only borrow an amount you’re comfortable with.

How to Buy Struck-Off Property in Texas?

Conclusion

Using equity to buy an investment property can be a smart financial move, allowing you to leverage the equity in your existing property to build wealth and generate passive income.

It is essential to carefully consider the risks and benefits before purchasing.

Proper planning and management can make investing in real estate a profitable long-term investment.

FAQs

What is the loan-to-value (LTV) ratio?

The loan-to-value (LTV) ratio is the maximum amount a lender is willing to lend you based on the value of your property.

Most lenders require a maximum LTV ratio of 80%, meaning you can borrow up to 80% of the value of your property.

What is the difference between a conventional loan and a hard money loan?

Banks and financial institutions offer conventional loans with favorable terms and interest rates.

A hard money loan is a short-term loan offered by private lenders with higher interest rates and fees but can be a good option if you need to close quickly or have poor credit.

How do I find an investment property?

There are several ways to find an investment property, including working with a real estate agent, attending auctions, and searching online listings.

What is property management?

Property management involves ensuring the property is in good condition, handling tenant complaints, and collecting rent.

A property management company can handle these tasks, ensuring the property is well-maintained and profitable.

Why is tenant screening important?

Tenant screening is an essential part of managing an investment property.

It involves reviewing tenant applications, conducting background checks, and verifying income and employment.

Proper tenant screening can help avoid problem tenants and ensure a steady rental income stream.