How to Use Home Equity to Buy Rental Property?

Are you a homeowner looking to invest in rental property?

One way to finance your investment is by tapping into your home equity.

Using your home equity to buy rental property can be brilliant but requires careful planning and consideration.

In this article, I will share how to use home equity to buy rental property and what you need to know before investing.

Understanding Home Equity

Before using home equity to buy a rental property, let’s define home equity.

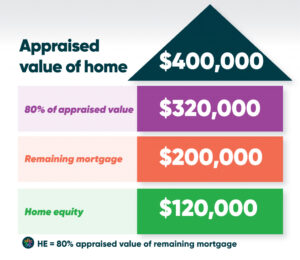

Home equity is the difference between your home’s current market value and the outstanding balance on your mortgage.

In other words, it’s the amount of your home you own.

Home equity works in your favour as you pay your mortgage and your home’s value increases.

For example, if your home is worth $500,000 and you owe $300,000 on your mortgage, then you have $200,000 in home equity.

Using Home Equity to Buy Rental Property

Using your home equity to buy rental property has some benefits, including:

- Lower interest rates: Home equity loans and lines of credit typically have lower interest rates than other types of financing, such as credit cards or personal loans.

- Tax benefits: The interest you pay on a home equity loan or line of credit may be tax-deductible, saving you money on your taxes.

- Higher loan amounts: You may be able to borrow more money with a home equity loan or line of credit than you would with other types of financing.

Risks

There are also risks involved in using home equity to buy a rental property, such as:

- Your home is collateral: If you default on your home equity loan or line of credit, you could lose your home.

- Interest rates may increase: If interest rates increase, your monthly payments on your home equity loan or line of credit may increase.

- Rental property income may not cover the loan payments: If you ca be unable to rent out your property or if rental income doesn’t cover your loan payments, you could end up in financial trouble.

How to use home equity to buy a rental property?

If you decide to use your home equity to buy a rental property, ensure you have a solid plan and can afford the loan payments. Here are some steps you can take:

- Determine how much equity you have in your home: Calculate your home equity by subtracting your outstanding mortgage balance from your home’s current market value.

- Determine how much you can borrow: Lenders typically allow you to borrow up to 80% of your home’s equity.

- Shop for the best loan: Compare interest rates and terms from multiple lenders to find the best loan.

- Have a solid plan for your rental property: Make sure you have a solid plan for your rental property, including how much rent you can charge, how you’ll manage the property, and how you’ll handle any unexpected expenses.

Risks of Using a Home Equity Loan to Buy Rental Property

Here are some of the main risks of using a home equity loan to buy rental property:

Higher debt burden – You’ll have the mortgage on your primary residence plus the home equity loan to buy the rental property. This increases your total debt and monthly payments, which may strain your finances.

Interest costs – Home equity loans typically have higher interest rates than traditional mortgages. You’ll pay more in total interest costs over time.

Risk of default – If the rental property does not generate enough income or has high maintenance costs, you may have trouble making the home equity loan payments. This could lead to default or foreclosure.

Less favourable terms – Home equity loans usually have shorter terms (often ten years or less), and you can’t refinance them as quickly as traditional mortgages.

Security risk – Your primary residence is used as collateral for the home equity loan. If you default, you could lose your home.

Rental property risks – Many risks are associated with rental properties, including vacancy periods, tenant damages, unexpected maintenance costs, etc.

Loss of home equity – The amount of equity you have in your primary residence will be reduced due to the home equity loan. This may limit your ability to tap this equity for future needs.

How to Buy Property in Puerto Rico?

Is investing in Rental Properties risky?

Investing in rental property can be risky, but it can also be profitable if done correctly. Here are some points regarding the risks and rewards of rental property investing:

Vacancies – Tenants can leave any time, causing periods of no rental income. This can be stressful and financially challenging.

Property damage – Tenants can damage the property beyond normal wear and tear, costing the landlord money to repair.

Non-payment of rent – Tenants may fall behind or stop paying rent altogether, which the landlord must then pursue legally.

Higher maintenance costs – Owning property means more maintenance and repairs over time, which can be expensive.

Interest rate risk – Rising interest rates can increase mortgage payments, cutting cash flow.

Property value decline – Property values can decrease, leaving the landlord with less equity or owing more than the property is worth.

FAQs

What is home equity?

Home equity is the difference between your home’s current market value and the outstanding balance on your mortgage.

How do I calculate my home equity?

Calculate your home equity by subtracting your outstanding mortgage balance from your home’s current market value.

What are the benefits of using home equity to buy rental property?

The benefits of using home equity to buy rental property include lower interest rates, tax benefits, and higher loan amounts.

What are the risks of using home equity to buy rental property?

The risks of using home equity to buy rental property include that your home is collateral, interest rates may increase, and rental property income may not cover the loan payments.

How can I mitigate the risks of using home equity to buy rental property?

To mitigate the risks of using home equity to buy a rental property, make sure you have a solid plan in place for your rental property, including how much rent you can charge, how you’ll manage the property, and how you’ll handle any unexpected expenses.

Ensure you can afford the loan payments even if rental income doesn’t cover them.

Finally, shop for the best loan terms and interest rates to get the best deal possible.

Conclusion

Using home equity to buy rental property can be wise if you have a solid plan and can afford the loan payments.

It’s essential to weigh the risks and benefits before making this investment.

Make sure you understand how home equity works and that you can afford the loan payments before you make this investment.