Should I Buy a Commercial Property for My Business?

As a business owner, one of the most significant decisions you will make is whether or not to buy a commercial property for your business.

It can be a daunting decision, with many factors to consider.

In this article, we will explore the pros and cons of buying a commercial property for your business and help you make an informed decision.

Advantages of Buying a Commercial Property

Investment potential

One of the most significant advantages of buying a commercial property for your business is the investment potential.

Owning a commercial property can be a wise investment if the property’s value increases over time.

You can also use the property as collateral for future financing.

Control over your business location.

When you own a commercial property, you have complete control over the location of your business.

You can customize the property to meet your business needs, and you don’t have to worry about a landlord dictating what you can and cannot do with the property.

Tax benefits

Owning a commercial property can provide significant tax benefits.

You may be able to deduct mortgage interest, property taxes, and other expenses from your business income, reducing your tax liability.

Additionally, if you sell the property at a profit, you may be able to defer or reduce capital gains taxes.

Fixed costs

When you own a commercial property, you have a fixed cost for your business location.

You don’t have to worry about rent increases or renegotiating leases every few years.

This can provide stability and predictability for your business.

Disadvantages of Buying a Commercial Property

Large initial investment

One of the most significant disadvantages of buying a commercial property is the investment required.

You will need to come up with a substantial down payment, and you may need to take on a significant amount of debt to finance the purchase.

Responsibility for upkeep and maintenance

When you own a commercial property, you are responsible for the upkeep and maintenance of the property.

This can be costly and time-consuming, especially if significant repairs or renovations are needed.

Limited flexibility

When you own a commercial property, you are locked into that location.

If your business needs change, you may not be able to move to a new location quickly. This can limit your flexibility and growth potential.

Market fluctuations

The value of commercial properties can fluctuate based on market conditions. If the market takes a downturn, you may end up with a property worth less than what you paid.

How to Buy Your First Rental Property?

Factors to Consider When Deciding Whether to Buy a Commercial Property

Location

Location is a critical factor when deciding whether to buy a commercial property.

You want to choose a location that is convenient for your customers and employees and has the potential for growth and development.

Business type and growth potential

The type of business you have and its growth potential are important factors to consider when deciding whether to buy a commercial property.

If your business is likely to increase, you may need a larger space in the future, which could impact your decision to buy.

Financing options

When considering buying a commercial property, you need to evaluate your financing options carefully.

You will need to make a substantial down payment, and you may need to take on a significant amount of debt.

Ensure you have a solid financing plan before making a purchase.

Market conditions

The current state of the commercial real estate market is essential when deciding whether to buy a commercial property. You want to make sure you are buying at the right time and that the property has the potential to increase in value over time.

Is it a good idea to buy commercial property?

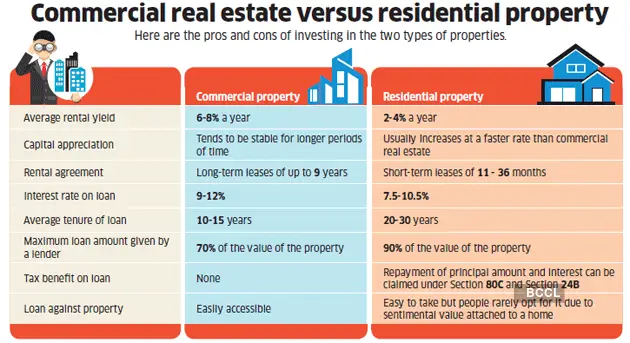

There are some pros and cons to buying commercial property:

Pros:

• Potential rental income – If you lease out the property, you can generate revenue from rent. Commercial rents tend to be higher than residential rents.

• Appreciation – Commercial property values can appreciate over time, especially in growing areas. You may be able to sell the property for more than you bought it for.

• Tax benefits – Various tax deductions and credits are available for commercial property owners, which can reduce your tax burden.

• Hedge against inflation – Commercial real estate has historically kept pace with or exceeded inflation, so it can help preserve your purchasing power over time.

Cons:

• Higher costs – Commercial properties tend to have higher purchase prices, taxes, insurance, and maintenance costs than residential properties.

• Harder to sell – Commercial properties often take longer than residential properties.

• More risk – Commercial properties have a higher risk of vacancy periods with no rental income. Economic downturns can also more severely impact commercial real estate values.

•Requires management– You must hire and oversee property managers unless you actively manage and maintain the property. This adds a layer of complexity.

What type of commercial property is most profitable?

There is no “most” profitable type of commercial property. Different varieties have different risk and return profiles. Some of the most common commercial property types and their pros/cons are:

Retail:

Pro: Often has stable tenants like grocery stores and pharmacies.

Con: Can be sensitive to e-commerce and economic downturns. Vacancy rates tend to be higher for retail properties.

Office:

Pro: Steady income stream from long-term leases.

Con: Tenants can be fickle and move locations quickly. Sensitive to economic conditions.

Industrial:

Pro: Generally low vacancy rates and stable demand from manufacturing and logistics tenants.

Con: Properties require more maintenance and upkeep.

Medical:

Pro: Stable income from medical tenants and low vacancy rates.

Con: High purchase prices due to strong demand.

Multifamily:

Pro: Generally stable cash flow due to recurring rents.

Con: Higher operating costs and property management requirements.

Self-storage:

Pro: High operating margins and relatively stable cash flow.

Con: Highly concentrated risks if the property does not fill up.

It’s nearly impossible to definitively claim that one type is “most” profitable. Performance depends heavily on the property, location, tenants, management, and economic conditions. Property type preferences vary based on an investor’s risk tolerance, time horizon, and investment goals.

The critical factors are thorough due diligence, proper valuation, and an in-depth understanding of the property and market. Any commercial property type can be profitable with the right strategy, insights, and expertise.

Is commercial property investment profitable?

Yes, commercial property investment can be highly profitable, but there are no guarantees. Some key points:

• Commercial property has the potential for higher returns compared to residential real estate due to higher rents and fewer ownership constraints. However, the risks are also higher.

• Stable, long-term commercial tenants can provide a reliable income stream through leases. But vacancy periods and difficult tenants can be very costly.

• Commercial property values appreciate over time, especially in growing areas with strong demand. However, deals can stagnate or decline, as witnessed during the 2008 financial crisis.

• Proper management and oversight are critical to the success of a commercial property investment. Costs must be controlled, and tenants must be kept happy.

• Different commercial property types have varying risk-return profiles. Some, like medical and industrial, tend to have more stable returns. Others, like retail, are at higher risk.

• Location is critical, as certain areas have more robust economic and demographic fundamentals that drive property performance. Thorough market research is a must.

• Commercial properties often require more significant capital outlays and more leveraged financing. This magnifies both potential profits and losses.

• Tax advantages and cash flow from rents can boost the profitability of commercial real estate investments. But taxes and expenses also eat into profits.

FAQs

What are the financing options for buying a commercial property?

Several financing options are available for buying a commercial property, including traditional bank loans, Small Business Administration (SBA) loans, and commercial mortgage-backed securities (CMBS).

What are the tax benefits of owning a commercial property?

Commercial property can provide significant tax benefits, including deducting mortgage interest, property taxes, and other expenses from your business income, reducing your tax liability.

If you sell the property at a profit, you may be able to defer or reduce capital gains taxes.

What should I consider when choosing a location for my commercial property?

When choosing a location for your commercial property, you should consider factors such as convenience for your customers and employees, the potential for growth and development, and accessibility to necessary amenities and resources.

How can I buy in the commercial real estate market at the right time?

To ensure you are buying at the right time in the commercial real estate market, you should carefully evaluate market conditions, including trends in property values and demand, as well as economic and political factors that could impact the market.

What are some of the risks associated with buying a commercial property?

Some risks of buying a commercial property include market fluctuations, ongoing maintenance and repairs, and limited flexibility if your business needs to change.

What should I look for in a commercial property investment?

When evaluating a potential commercial property investment, you should look for factors such as location, the potential for growth and development, and the overall condition and potential of the property.

You should carefully evaluate financing options and market conditions to ensure you are making an intelligent investment decision.

Conclusion

Buying a commercial property for your business can be a wise investment, but it is not a decision to be taken lightly.

Before making a purchase, you need to carefully evaluate the advantages and disadvantages and the various factors that will impact your decision.

With the proper research and planning, you can make an informed decision that will benefit your business for years.