Where to Buy an Investment Property?

Are you thinking about investing in real estate?

Purchasing an investment property can be a great way to diversify your portfolio and generate passive income.

But where should you start looking for a property to invest in?

This article explores some of the best places to buy an investment property.

The Best Places to Buy an Investment Property

Before you start searching for an investment property, it’s important to research the market.

Look for areas where properties are appreciating, and rents are increasing.

It would be best to consider the area’s vacancy rate, as a high vacancy rate could indicate a weak rental market.

Location is one of the most important factors when buying an investment property.

Properties in high-demand areas with strong job growth and good schools are more likely to appreciate the value and generate consistent rental income.

Here are some of the top cities for investment properties:

Austin, TX

Austin is one of the fastest-growing cities in the United States, with a strong job market and a growing population.

The city has a low unemployment rate and is home to major employers, including Dell, IBM, and Amazon.

Austin’s strong economy and vibrant culture make it a popular destination for young professionals and families, creating a strong demand for rental properties.

Orlando, FL

Orlando is a popular tourist destination, with attractions like Disney World and Universal Studios drawing millions of visitors each year.

The city also has a strong job market, with major employers like Lockheed Martin and Walt Disney World.

Orlando’s warm climate and affordable housing market make it an attractive option for investors looking to generate rental income.

Atlanta, GA

Atlanta is a major economic hub in the Southeast, with a diverse economy and a growing population.

The city is home to major employers like Delta Air Lines, Coca-Cola, and Home Depot and has a strong rental market due to its growing population and job market.

Dallas, TX

Dallas is another fast-growing city in Texas, with a strong job market and a growing population.

The city is home to major employers like AT&T and American Airlines and has a growing tech sector.

Dallas also has a low cost of living and a strong rental market, making it an attractive option for investors.

Phoenix, AZ

Phoenix is the capital of Arizona and a major economic hub in the Southwest.

The city has a growing population and a strong job market, with major employers like Intel and Honeywell.

Phoenix’s warm climate and affordable housing market make it an attractive option for investors looking to generate rental income.

When considering where to buy an investment property, it’s also important to consider the local economy. Look for cities with diverse economies and strong job markets, creating a greater demand for rental properties.

In addition to location and the local economy, there are other factors to consider when buying an investment property.

Neighbourhood safety, property taxes, and available amenities can all affect the rental market and the value of your property.

Is Now a Good Time to Buy Investment Property?

How To Buy An Investment Property?

Here are the main steps to buy an investment property:

Determine your investment goals. Decide what type of investment property you want (single-family home, condo, duplex, etc.) and what level of cash flow and appreciation you seek.

Research the market. Study recent sales data, rental rates, vacancy rates, and property expenses in the area you’re interested in. This will help you determine the potential return on investment.

Save for a down payment. You’ll typically need at least 20% down to avoid paying private mortgage insurance (PMI). The higher your down payment, the lower your monthly mortgage payment will be.

Get pre-approved for a mortgage. Get pre-approved by a lender, so you know the maximum you can borrow and your potential monthly payments before making an offer.

Find a real estate agent. Find a good real estate agent familiar with investment properties in your target area. They can help you find the right property and make an offer.

Inspect the property thoroughly. Have inspectors thoroughly check the property – any issues can affect your rental income and appreciation potential.

Make an offer. Negotiate the final sale price and terms with the seller.

Secure financing. Once an offer is accepted, apply for a mortgage loan and lock in an interest rate.

Close to the property. At closing, you’ll transfer the funds, sign loan documents, and officially take ownership of the investment property.

Manage the property. You’ll need to find tenants, deal with maintenance issues, collect rent, handle other property management tasks or hire a property manager.

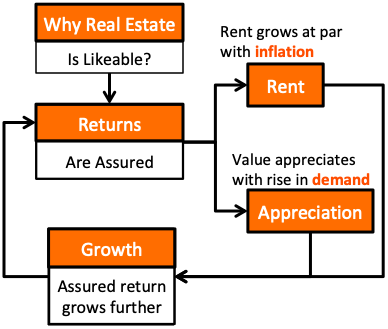

Why Should You Invest?

There are a few main reasons to invest in real estate, particularly investment properties:

• Appreciation: Real estate values typically appreciate over time, meaning the property increases in value. This can lead to significant capital gains when you eventually sell the property.

• Cash flow: Rental income from tenants can provide a positive cash flow after accounting for mortgage payments, taxes, insurance, maintenance, and other expenses. This cash flow can be a source of income.

• Tax benefits: Certain expenses related to investment properties, like mortgage interest, property taxes, and maintenance costs, are tax deductible. This can lower your taxable income and tax bill.

• Forced savings: Investing in real estate requires saving a substantial down payment. This can be a discipline to force yourself to save more.

• Portfolio diversification: Real estate typically has a low correlation with stocks and bonds, so adding investment properties can diversify your overall investment portfolio.

• Leverage: You can buy an investment property with a relatively small down payment (typically 20% or less) and leverage that into owning an entire property that may appreciate significantly over time.

• Hedge against inflation: Over the long run, real estate values tend to rise with inflation. So investment properties can help preserve your purchasing power.

• Access to rental income: The rental income from an investment property can provide an additional revenue stream, even if covering the mortgage payment.

FAQs

What should I look for when buying an investment property?

When buying an investment property, it’s important to consider the location, local economy, and other factors affecting the rental market.

Look for areas where properties are appreciating, and rents are increasing, and consider the vacancy rate in the area.

How can I finance an investment property?

Several ways to finance an investment property include traditional mortgages, hard money loans, and private loans.

Talk to a mortgage broker or financial advisor to determine the best financing option for your investment property.

What are the tax implications of owning an investment property?

Owning an investment property can have tax implications, including property taxes and rental income taxes.

Talk to a tax professional to determine the tax implications of owning an investment property in your area.

How can I ensure that my investment property is profitable?

Keeping your expenses and rental income low is important to ensure that your investment property is profitable.

Screen potential tenants carefully, and maintain your property in good condition.

What are some common mistakes to avoid when buying an investment property?

Some common mistakes to avoid when buying an investment property include overpaying for the property, not researching the market and the local economy, and not properly screening potential tenants.

It’s important to do your due diligence and thoroughly research the property and the surrounding area before investing.

Ensure a solid plan for managing the property and generating consistent rental income.

Conclusion

In conclusion, investing in real estate can be a great way to diversify your portfolio and generate passive income.

When looking for an investment property, consider the location, local economy, and other factors affecting the rental market.

With the right research and due diligence, you can find a property that will provide a steady stream of rental income for years.