Where To Buy Rental Properties in Dubai, New York and London?

Are you interested in investing in rental properties in Dubai, New York, or London?

You’ve come to the right place!

In this article, we will discuss the top locations to buy rental properties in these cities and what you need to know before making your investment.

Dubai Rental Properties

Dubai’s real estate market has been growing rapidly over the past few years, making it an attractive place to invest in rental properties.

The city is known for its luxury properties and high rental yields. The top locations to buy rental properties in Dubai are:

- Dubai Marina: This area is known for its waterfront properties and high-end lifestyle. It offers a variety of rental properties, from studios to penthouses.

- Downtown Dubai: This area is home to some of the most iconic buildings in Dubai, such as the Burj Khalifa and Dubai Mall. It offers a mix of residential and commercial properties.

- Jumeirah Village Circle: This area is popular among families and young professionals. It offers affordable rental properties with a good rental yield.

New York Rental Properties

New York’s real estate market is one of the most competitive in the world. However, it offers some of the highest rental yields in the US. The top locations to buy rental properties in New York are:

- Brooklyn: This borough has been growing rapidly over the past few years, making it an attractive place to invest in rental properties. It offers a mix of residential and commercial properties.

- Queens: This borough is known for its diverse population and affordable rental properties. It offers a good rental yield and a high potential for capital growth.

- Manhattan: This borough is home to some of the most iconic buildings in the world, such as the Empire State Building and the One World Trade Center. It offers luxury rental properties with a high rental yield.

London Rental Properties

London’s real estate market is one of the most established in the world. It offers a mix of residential and commercial properties, with a good rental yield and a high potential for capital growth. The top locations to buy rental properties in London are:

- Canary Wharf: This area is known for its luxury properties and high rental yields. It offers a mix of residential and commercial properties.

- Brixton: This area is popular among young professionals and families. It offers affordable rental properties with a good rental yield.

- Notting Hill: This area is known for its vibrant culture and expensive properties. It offers luxury rental properties with a high rental yield.

Factors to Consider Before Investing

Before investing in rental properties in Dubai, New York, or London, there are a few factors you need to consider:

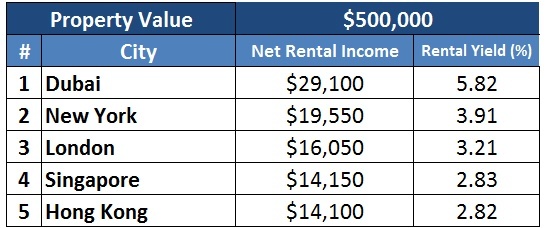

- Rental Yield: The rental yield is the amount of rent you will receive compared to the property’s purchase price. You should aim for a rental yield of at least 5%.

- Capital Growth: The capital growth is the increase in the property’s value over time. You should aim for a capital growth of at least 3% per year.

- Vacancy Rates: The vacancy rates are the number of days the property is empty. You should aim for a vacancy rate of less than 5%.

- Property Management: The property management is the process of maintaining the property and dealing with tenants. You should consider hiring a property management company to take care of the property for you.

Which place in Dubai is best for rental income?

There are a few places in Dubai that tend to offer strong rental income potential:

• Downtown Dubai – Areas like Downtown Dubai, Business Bay and DIFC tend to attract a lot of white collar expat professionals due to their proximity to major business hubs and amenities. This drives up rental demand and prices. However, properties in these areas can be more expensive to buy initially.

• Marina – The Marina area is a popular beachfront residential neighborhood that has attracted many expat residents over the years. This has led to an established rental market there with relatively high rental yields. Property prices have also risen significantly in the Marina in recent years.

• Jumeirah Lake Towers – JLT is another popular residential community close to the business hubs. It has a mix of apartments and villas that appeal to different renter demographics, helping support demand. Rental yields tend to be decent, though not as high as some other areas.

• Dubai Silicon Oasis – This residential freezone community is close to academic institutions and targets knowledge workers and students. The supply of rental units matches the demand, allowing for reasonable rental prices and yields. Property prices are also more affordable compared to places like the Marina.

Is Dubai a good place to invest in real estate?

Dubai’s real estate market has pros as an investment:

• Strong rental demand – There is consistently high demand for rental properties in Dubai from the large expat population. This helps support rental income potential.

• Government support – The Dubai government has taken active steps to support the real estate sector through initiatives like offering long-term residency visas and easing property ownership rules. This boosts investor confidence.

• Diversification – Investing in Dubai real estate provides geographic diversification for international property investors compared to just investing in their home markets.

FAQs

What is the rental yield?

The rental yield is the amount of rent you will receive compared to the property’s purchase price.

What is the capital growth?

The capital growth is the increase in the property’s value over time.

What is the vacancy rate?

The vacancy rate is the number of days the property is empty.

What is property management?

Property management is the process of maintaining the property and dealing with tenants.

Should I hire a property management company?

It’s recommended to hire a property management company to take care of the property for you.

Conclusion

Investing in rental properties in Dubai, New York, or London can be a great way to generate a passive income. However, it’s important to do your research before making your investment. Consider the rental yield, capital growth, vacancy rates, and property management before making your decision.