Can You Use a HELOC to Buy an Investment Property?

In this article, I will explain a HELOC, how it works, and how to use it to purchase an investment property. I will also discuss the pros and cons of using a HELOC and provide tips on qualifying for one.

What is a HELOC?

A HELOC loan allows you to borrow money against the equity you have in your home.

Equity is the difference between the value of your home and the amount you owe on your mortgage. For example, if your home is worth $500,000 and you owe $300,000 on your mortgage, you have $200,000 in equity.

A HELOC works like a credit card, where you can borrow money up to a specific limit and only pay interest on the amount you borrow.

The interest rate on a HELOC is usually variable, meaning it can go up or down depending on the market.

How does a HELOC work?

To get a HELOC, you must apply with a lender and appraise your home to determine its value. The lender will also review your credit score, income, and debt-to-income ratio to determine your qualifications.

Once approved, you can borrow money from your HELOC up to the limit the lender sets. You can use the funds for any purpose, including buying an investment property.

You only have to make payments on the amount you borrow, and the interest is tax-deductible if you use the money for home improvements or to buy an investment property.

Using a HELOC to buy an investment property

Using a HELOC to buy an investment property can be a smart strategy, especially if you have a lot of equity in your home. Here are the steps to follow:

- Determine how much equity you have in your home by subtracting the amount you owe on your mortgage from its current market value.

- Apply for a HELOC with a lender and get approved.

- Use the money from your HELOC to buy an investment property.

- Make payments on your HELOC, which will include both principal and interest.

- Rent the investment property and use the income to pay off your HELOC.

Pros and cons of using a HELOC

Using a HELOC to buy an investment property has its advantages and disadvantages. Here are some of the pros and cons:

Pros

- You can use the equity in your home to finance an investment property.

- You only pay interest on the amount you borrow.

- The interest is tax-deductible if you use the money for home improvements or to buy an investment property.

- You can use the income from the investment property to pay off your HELOC faster.

Cons

- Your home is used as collateral, which means you could lose it if you default on your payments.

- The interest rate on a HELOC is usually variable, meaning it can go up or down depending on the market.

- You must have good credit and a low debt-to-income ratio to qualify for a HELOC.

- If the housing market crashes, you could owe more on your HELOC than your home is worth.

Qualifying for a HELOC

To qualify for a HELOC, you must have a good credit score, a low debt-to-income ratio, and a significant amount of equity in your home.

Most lenders require a credit score of at least 680 and a debt-to-income ratio of 43% or lower.

You also need to have a stable source of income and a good payment history on your mortgage.

If you have a low credit score or a high debt-to-income ratio, you may still qualify for a HELOC but will likely pay a higher interest rate.

How Many Properties Can You Buy in a 1031 Exchange?

FAQs

Can I use a HELOC to buy any investment property?

Yes, you can use a HELOC to buy any investment property, including a rental, vacation home, or commercial property.

What is the maximum amount I can borrow with a HELOC?

The maximum amount you can borrow with a HELOC depends on the equity you have in your home and the lender’s limit.

Most lenders allow you to borrow up to 85% of your home’s value minus the amount you owe on your mortgage.

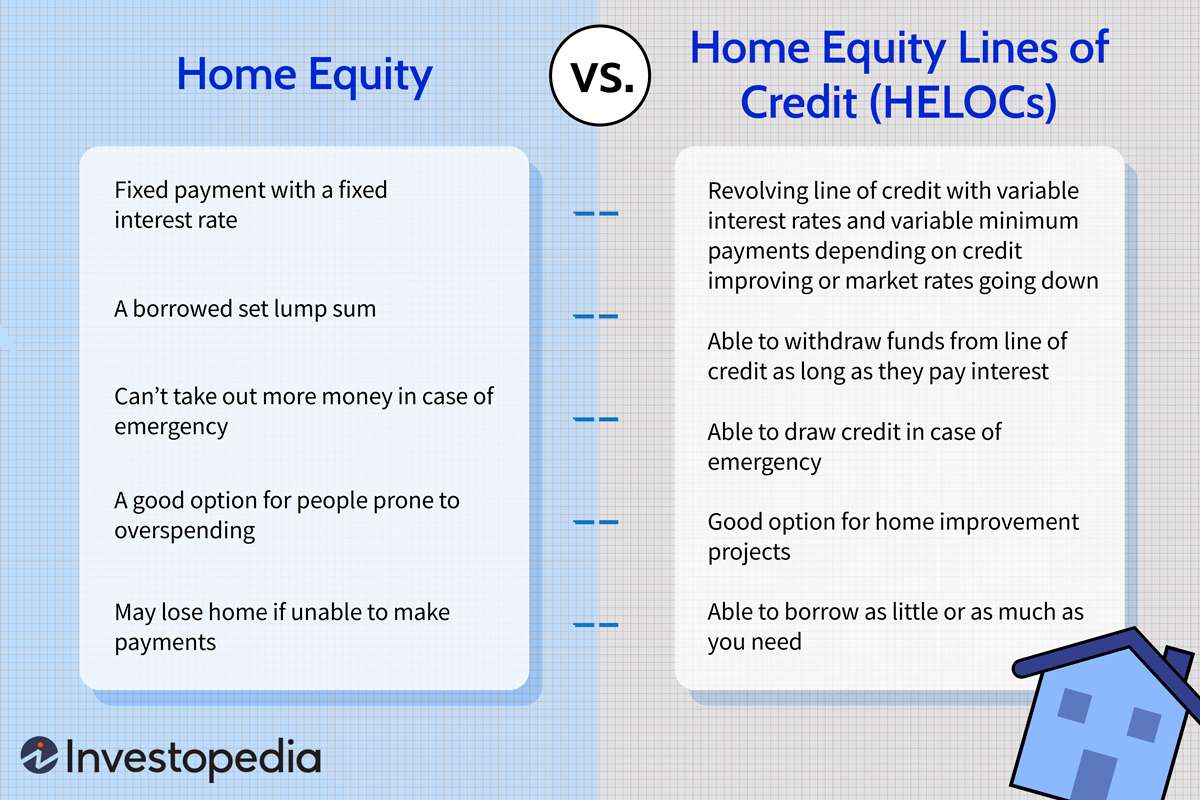

What is the difference between a HELOC and a home equity loan?

A HELOC is a revolving line of credit that allows you to borrow money as needed, while a home equity loan is a lump sum loan you receive all at once.

With a HELOC, you only pay interest on the amount you borrow, while with a home equity loan, you pay interest on the entire amount.

How long does it take to get approved for a HELOC?

The time it takes to get approved for a HELOC varies depending on the lender and your financial situation. It can take anywhere from a few days to several weeks to get approved.

Can I use a HELOC to pay off my debt?

You can use a HELOC to pay off credit card debt, student loans, and personal loans. However, it’s essential to have a plan to pay off your HELOC, as it’s still a debt.

Can I use a HELOC to buy an investment property if I don’t have a primary residence?

No, having a primary residence to qualify for a HELOC would be best. If you don’t have a primary residence, you can consider other forms of financing, such as a conventional loan or a cash purchase.

Conclusion

Using a HELOC to buy an investment property can be an intelligent strategy, but it’s not without risks.

You need a significant amount of equity in your home and a good credit score to qualify.

Before using a HELOC, understand the risks and benefits and have a solid plan to pay it off.

If you’re uncomfortable using your home as collateral, there are other ways to finance an investment property, such as a conventional loan or a cash purchase.