How to Buy Multiple Properties With No Money?

Are you tired of living paycheck to paycheck and dreaming of a better life?

Have you ever considered investing in real estate, but coming up with a sizeable down payment seems daunting?

Well, there is good news for you!

It is possible to buy multiple properties with no money down. This article will provide you with the steps and strategies needed to make this dream a reality.

Understanding No Money Down

No money down investing refers to buying a property without putting any of your money into the deal. This may sound too good to be accurate, but it is possible through creative financing strategies and finding properties with motivated sellers.

Strategies for No Money Down Investing

- Wholesaling: Wholesaling involves finding an undervalued property, putting it under contract, and then assigning the contract to an investor for a fee. The fee received from the investor can be used as the down payment on another property.

- Lease Options: Lease options allow you to control a property without owning it outright. You can negotiate a lease option with a motivated seller and then sublease the property to a tenant. The tenant’s monthly rent payments can be used to cover the mortgage on the property while also providing cash flow for you.

- Seller Financing: Seller financing is when the seller agrees to finance the purchase of their property. This can be done through a variety of methods, such as a land contract, mortgage, or deed of trust.

Finding the Right Properties

It would be best to look for motivated sellers willing to negotiate to find suitable properties for no money-down investing. This can include properties that have been on the market for an extended period, estate sales, or properties that need significant repairs.

Creative Financing Options

- Hard Money Loans: Hard money loans are short-term loans typically used for real estate investing. These loans are based on the value of the property instead of your credit score and can be used to purchase a property or cover the down payment.

- Private Money Lenders: Private money lenders are individuals or companies who lend money to real estate investors. These lenders may be more flexible than traditional lenders and willing to provide financing for a no-money-down deal.

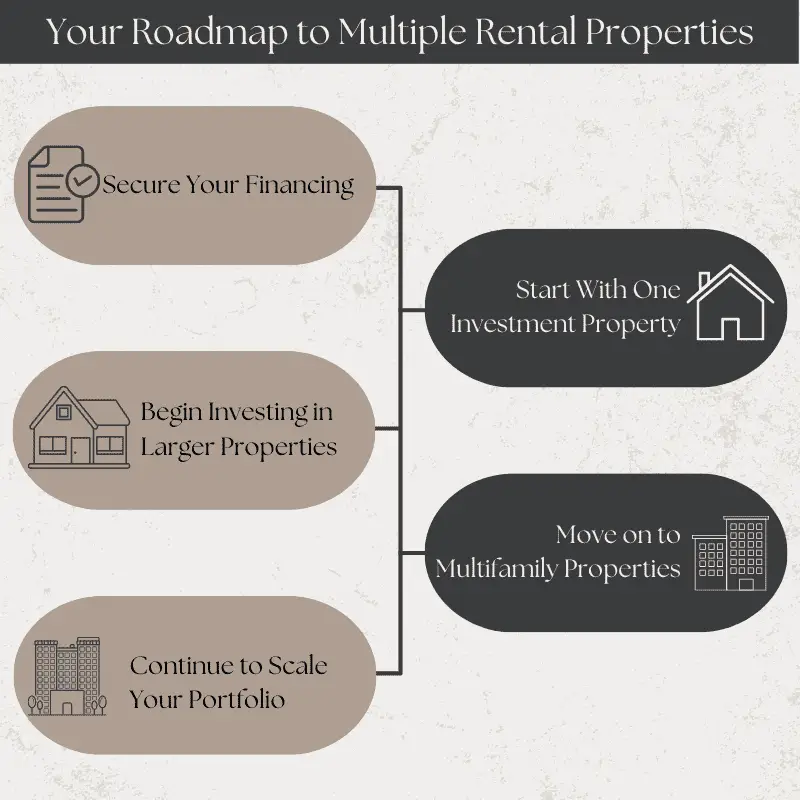

Building Your Real Estate Portfolio

Once you have successfully purchased your first property with no money down, you can use the profits from that property to buy additional properties. This strategy is known as the snowball effect and can lead to significant wealth accumulation over time.

Mitigating Risks

No money-down investing comes with risks, but there are ways to mitigate them. One way is to thoroughly research the property and the market before purchasing. Additionally, having a contingency plan in place can help protect you in case of unforeseen circumstances.FAQs

How many properties one can buy?

There is no set limit on the number of properties one can buy. Some factors that impact how much property one can purchase include:

Financial resources: You need sufficient funds to purchase properties, either through savings, income, loans, or investments. The more extensive your financial resources, the more property you may be able to acquire.

Property availability: Properties must be available for sale for you to purchase them. In some markets, scorching real estate markets, limited inventory may be available at any given time.

Ability to manage properties: The more properties you own, the more management and maintenance they require. You need sufficient time, skills and resources to manage multiple properties effectively. This can include hiring property management companies.

Loan approval: Mortgage lenders typically have limits on the number and total dollar amount of loans they will extend to a single borrower. This can impact how much property you can purchase using financing.

Tax implications: Owning multiple properties can impact your tax situation, with some tax advantages and additional complexities that grow as the number of properties increases. Speak with a tax professional to understand the tax implications.

Legal restrictions: In some cases, legal restrictions may limit how much property one individual or company can own within a particular region. This varies significantly by location.

Can You Use a HELOC to Buy an Investment Property?

What are the risks of buying multiple properties with no money down?

Here are some significant risks of buying multiple properties with no money down:

Higher costs: You’ll likely have to pay higher interest rates since you’re not spending money. This can significantly increase your costs over time.

Cash flow issues: You may struggle to cover expenses like mortgages, taxes, insurance, maintenance, and vacancies with no cash reserves. This can put a strain on your finances.

Higher default risk: Lenders see you as a higher-risk borrower since you put nothing down. If you default, the lender loses more money.

Limited cash reserves: You have no buffer for repairs or updates. You’ll have to come up with cash some other way, or the properties could fall into disrepair.

Higher risk of foreclosure: If you struggle to make payments or cover expenses, foreclosure is a real risk. This can damage your credit and business reputation.

Difficulty attracting tenants or buyers: Properties bought with no money may seem riskier to potential tenants or future buyers. This could lower rents or future sale prices.

Less profitable: Putting no money down means you have no equity in the property right away. You miss out on potential short-term gains if the property appreciates.

Potential tax issues: The IRS scrutinizes no-money-down transactions more closely for possible tax evasion. You’ll need good records and documentation.

FAQs

What are some creative financing options for no money down investing?

Some creative financing options include hard money loans, private money lenders, and seller financing.

How can I mitigate risks when investing in real estate without money?

You can mitigate risks by thoroughly researching the property and market, having a contingency plan, and having a clear exit strategy.

How can I build my real estate portfolio with no money down?

You can build your real estate portfolio with no money down by using the profits from your first property to purchase additional properties. This strategy is known as the snowball effect.

Conclusion

No money-down investing is possible with the right strategies and mindset.

By finding motivated sellers, utilizing creative financing options, and building your real estate portfolio, you can achieve financial freedom and live the life you’ve always dreamed of.