How Many Properties Can You Buy in a 1031 Exchange?

Regarding 1031 exchanges, many investors are curious about the number of properties they can buy.

The good news is that there is no limit to the number of properties you can buy in a 1031 exchange.

You must follow specific rules to ensure that your exchange is valid and that you qualify for tax deferral.

This article explores the ins and outs of 1031 exchanges and how many properties you can buy.

What is a 1031 exchange?

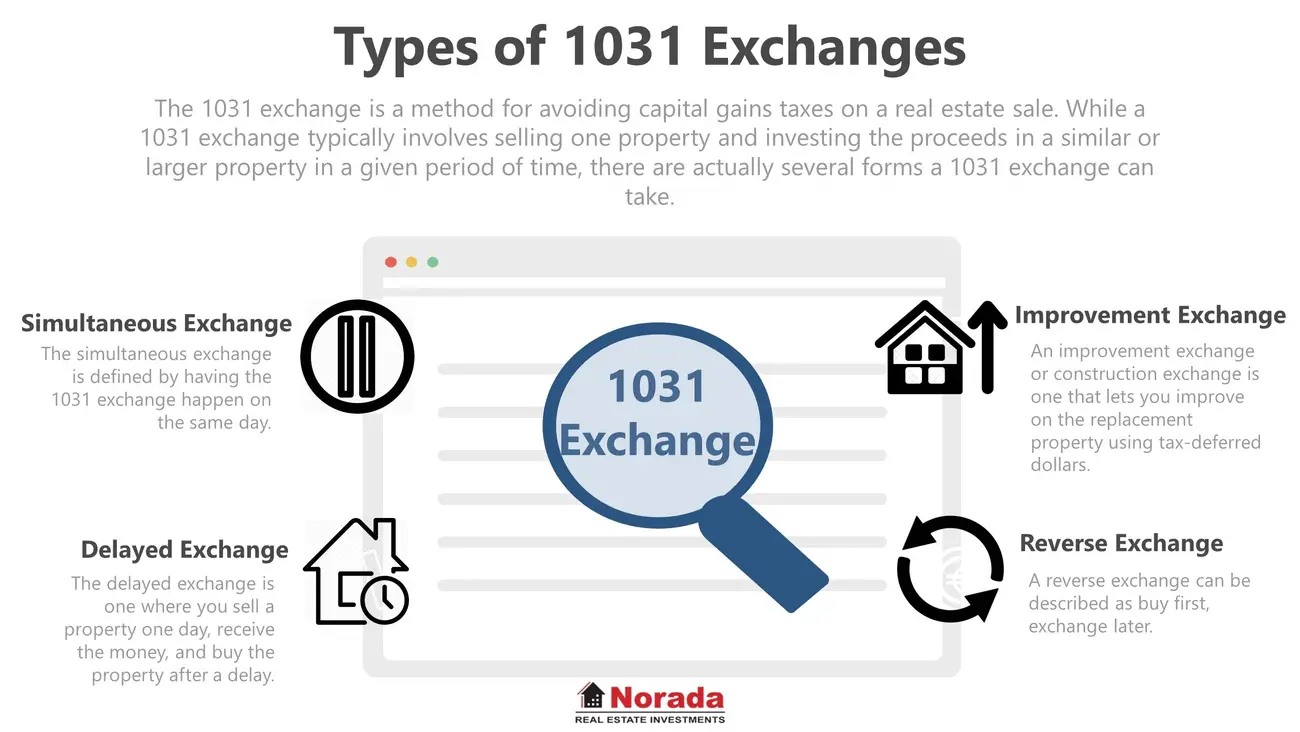

A 1031 exchange, a like-kind exchange, is a tax-deferred exchange that allows real estate investors to sell one or more properties and reinvest the proceeds into one or more replacement properties.

The purpose of a 1031 exchange is to allow investors to defer paying taxes on the gains from the sale of their property, which can be reinvested to purchase new properties.

The rules of a 1031 exchange

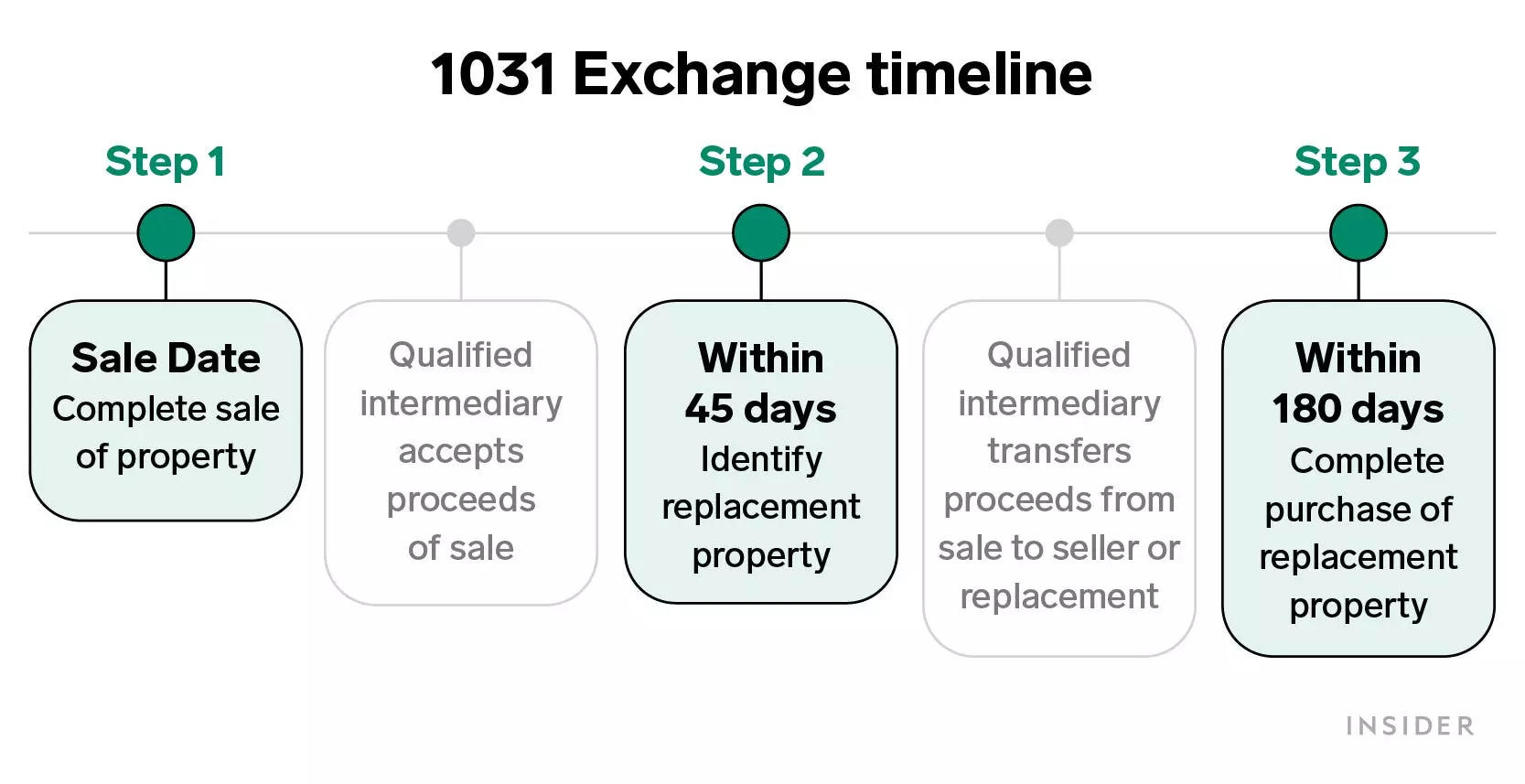

To qualify for a 1031 exchange, investors must follow specific rules.

- First, the properties being sold and purchased must be like-kind, meaning they must be exact or character, even if they differ in quality or grade.

- Second, the properties must be held for investment or business purposes.

- Third, the investor must identify replacement properties within 45 days of selling their original property.

- Fourth, the investor must complete the exchange within 180 days of selling their original property.

How many properties can you buy in a 1031 exchange?

As mentioned earlier, there is no limit to the number of properties you can buy in a 1031 exchange.

There are some factors to consider. The first factor is the value of the properties being purchased.

The total value of the replacement properties must be equal to or greater than the value of the sold property.

The investor must reinvest all of the proceeds from selling their original property.

Another factor to consider is the identification rules. The investor must identify replacement properties within 45 days of selling their original property, and there are specific rules regarding how many properties can be determined.

The investor can identify up to three properties of any value or specify any number of properties as long as the total value of the properties does not exceed 200% of the value of the property being sold.

Strategies for buying multiple properties in a 1031 exchange

If you’re interested in purchasing multiple properties in a 1031 exchange, you can use a few strategies.

One strategy is to purchase a single replacement property with multiple units, such as an apartment complex or commercial building.

Another strategy is to purchase multiple properties in the same geographic area, making management and maintenance easier.

The benefits of a 1031 exchange

There are several benefits to a 1031 exchange, including tax deferral, the ability to consolidate or diversify your real estate portfolio, and the potential for increased cash flow and appreciation.

A 1031 exchange can provide a way to dispose of underperforming properties and acquire more profitable ones.

The potential downsides of a 1031 exchange

While there are many benefits to a 1031 exchange, there are also some potential downsides to consider.

One downside is that the identification and timing rules can be strict, requiring investors to act quickly and make decisions that may not be ideal.

Another downside is that if the investor decides to sell their replacement property, they may be subject to capital gains taxes on the sale amount.

Can you use multiple properties in a 1031 exchange?

Yes, you can use multiple properties in a 1031 exchange. Here are some key points to understand:

A 1031 exchange allows you to defer capital gains taxes when you sell a business or investment property and reinvest the proceeds into similar “like-kind” business or investment property within certain time limits.

You can exchange multiple real estate properties as long as the combined value of the properties you sell does not exceed the combined weight of the replacement properties you purchase. The deal does not have to be equal, but there are limits on cashing out some of the proceeds.

The properties do not need to be identical, but they must qualify as “like-kind.” For real estate, this typically means any investment or business that uses the property. So you could sell an apartment building and buy a commercial office building, for example.

You will typically work with a qualified intermediary to facilitate a multi-property 1031 exchange. They will receive the proceeds from the sale of the properties you sell, hold the funds, and then disburse the funds for your purchase of replacement properties.

You generally have 45 days from the sale of a property to identify potential replacement properties and 180 days to complete the purchase of the replacement properties to defer the capital gains entirely.

Can you live in a 1031 exchange property?

No, you typically cannot live in a property involved in a 1031 exchange. There are a few main reasons for this:

To qualify for a 1031 exchange, the properties must be considered “investment” or “business use” properties. A primary residence does not qualify.

Living in a property involved in a 1031 exchange, even temporarily, could disqualify the exchange. The IRS considers the personal use of the property.

Since capital gains taxes on primary residences differ, living in an exchange property could create tax issues and complicate the exchange.

Many title companies and qualified intermediaries will not facilitate an exchange involving a property used as a primary residence to avoid potential tax problems.

So, in the short, property involved in a 1031 exchange should remain purely an investment or rental property not used as a primary residence, vacation home, or secondary home.

For a primary residence, you would typically sell the home and pay any capital gains taxes owed rather than doing a 1031 exchange.

The main exception would be if you temporarily lived in an investment property before or after the exchange, as long as the “primary purpose” of owning the property remained investment or business use.

But typically, avoiding using a property as a primary residence is recommended to maintain a “clean” 1031 exchange.

How to Buy a Commercial Property With No Money?

Is there minimum ownership for the 1031 exchange?

Yes, there is a minimum ownership period required for properties involved in a 1031 exchange.

This ensures the properties are considered “investment properties” rather than properties purchased to do an immediate exchange.

The IRS generally requires that you own and use the “relinquished property” (the property you sell) as an investment property for at least two full years out of the last five years before the exchange.

This is known as the “holding period” requirement.

The primary purpose of the two-year holding period rule is to discourage taxpayers from purchasing properties with the primary purpose of doing an immediate exchange.

The IRS wants to ensure the property being sold was an actual investment property for some time.

If you inherited and owned an investment property for less than two years, some exceptions might allow you to do a 1031 exchange with that property still.

There are also a few other limited exceptions to the two-year rule in some circumstances.

But in general, to do a “clean” 1031 exchange with no issues, it’s recommended to have owned the property being sold for at least two full years before the exchange to satisfy the IRS “holding period” requirement.

What is better than a 1031 exchange?

There are some alternatives to a 1031 exchange that may make sense in certain situations:

Just sell the property and pay capital gains taxes – This can make sense if you do not have a suitable replacement property in mind or want cash proceeds rather than tying up funds in a new investment property. The benefit is simplicity and liquidity.

Use a 121 exclusion – For primary residences; Section 121 allows you to exclude up to $250,000 of capital gains for single filers and $500,000 for joint filers. This only applies to primary residences, not investment properties.

Structure as a UpREIT – You can contribute your property to a Upreit, a type of real estate investment trust, in exchange for operating partnership units rather than cash. This can defer taxes similar to a 1031 exchange.

Use a Delaware Statutory Trust (DST) – You can contribute your property to a DST investment fund in exchange for shares. This can also potentially defer taxes, though DSTs come with additional complexity and fees.

Invest in other assets – Depending on your goals, and you could potentially diversify into other asset classes rather than just more real estate, like stocks, bonds, private equity funds, etc.

FAQs

What is a 1031 exchange?

A 1031 exchange is a tax-deferred exchange that allows real estate investors to sell one or more properties and reinvest the proceeds into one or more replacement properties.

How many properties can you buy in a 1031 exchange?

There is no limit to the number of properties you can buy in a 1031 exchange if you follow the rules and reinvest all of the proceeds from the sale of your original parcel.

What are the rules of a 1031 exchange?

The rules of the 1031 exchange include buying like-kind properties, holding the properties for investment or business purposes, identifying replacement properties within 45 days of selling the original property, and completing the exchange within 180 days.

What are the identification rules for a 1031 exchange?

The investor can identify up to three properties of any value or specify any number of properties as long as the total value of the properties does not exceed 200% of the value of the property being sold.

What are the benefits of a 1031 exchange?

The benefits of a 1031 exchange include tax deferral, the ability to consolidate or diversify your real estate portfolio, increased cash flow and appreciation, and a way to dispose of underperforming properties and acquire more profitable ones.

What are the potential downsides of a 1031 exchange?

The potential downsides of a 1031 exchange include strict identification and timing rules, the requirement to make quick decisions, and the potential for capital gains taxes if the replacement property is sold.

Conclusion

In conclusion, there is no limit to the number of properties you can buy in a 1031 exchange as long as you follow the rules and reinvest all of the proceeds from the sale of your original parcel.

If you’re considering a 1031 exchange, it’s essential to work with a qualified intermediary and consult with a tax professional to ensure you’re making the right decisions for your portfolio.