How to Buy Multiple Rental Properties?

Are you looking to expand your real estate portfolio and buy multiple rental properties?

It can be a lucrative investment but requires careful planning and strategy.

This article will discuss buying multiple rental properties and growing your real estate business.

Buying multiple rental properties can be a great way to increase your passive income and build long-term wealth.

5 Steps on How to Buy Multiple Rental Properties

Here are five steps to help you buy multiple rental properties and grow your real estate portfolio.

Step 1: Assess Your Financial Situation

The first step to buying multiple rental properties is to assess your financial situation.

Owning multiple rental properties requires significant upfront costs, including down payments, closing, and property maintenance expenses.

It’s essential to have a solid financial foundation and a good credit score to qualify for a mortgage loan.

You should also consider your current debt-to-income ratio and evaluate your cash flow to ensure you can afford additional mortgage payments.

Step 2: Research the Real Estate Market

Before buying any properties, it’s crucial to research the real estate market to identify the most promising locations and property types.

Look for areas with high rental demand, low vacancy rates, and potential for property value appreciation.

You can use online real estate marketplaces, attend local real estate events, and work with a real estate agent to find good deals.

Step 3: Develop a Business Plan

Developing a business plan can help you set clear goals, identify your target market, and establish a strategy for buying and managing multiple rental properties.

Your business plan should include financial projections, a marketing plan, and a property management plan.

Establishing a timeline for achieving your investment goals and monitoring your progress regularly is also essential.

Steps you can take to develop a business plan for buying multiple rental properties:

- Define your goals. What do you hope to achieve by buying multiple rental properties? Do you want to generate passive income, build wealth, or both? Once you know your goals, you can develop a strategy for achieving them.

- Do your research. Before you start buying properties, studying and understanding your area’s real estate market is essential. This includes understanding the demand for rental properties, the cost of properties, and the rental rates in your area.

- Identify your target market. Who are you targeting with your rental properties? Are you targeting students, families, or professionals? Once you know your target market, you can start looking for properties in desirable locations that meet your target market’s needs.

- Secure financing. You’ll need to secure the funding unless you have the cash to buy multiple rental properties. Various financing options are available, so comparing rates and terms is essential before choosing a lender.

- Hire a property manager. Hiring a property manager is a good idea if you have the time and expertise to manage your rental properties. A property manager can handle the day-to-day operations of your properties, such as finding tenants, collecting rent, and addressing maintenance issues.

- Manage your expenses. When you own multiple rental properties, managing your costs carefully is essential. This includes tracking your income and expenses, budgeting for repairs and maintenance, and setting aside money for unexpected expenses.

- Be patient. Buying multiple rental properties is a long-term investment. Finding suitable properties, securing financing, and building a successful rental business takes time. Don’t expect to get rich quickly.

Step 4: Secure Financing

Financing is a critical step in buying multiple rental properties.

You can explore various financing options, including traditional mortgage loans, private and hard money loans, and seller financing.

Compare interest rates, fees, and terms to find the best financing option.

Before starting your property search, you should also get pre-approved for a mortgage loan to demonstrate your financial readiness to sellers and agents.

| NAME | COSTS |

|---|---|

| Property | Name of the property |

| Purchase price | Cost of purchasing the property |

| Rehab costs | Cost of repairing or renovating the property |

| Total investment | Purchase price + Rehab costs |

| Monthly rent | Expected monthly rent income from the property |

| Monthly expenses | Expected monthly expenses for the property, such as mortgage, taxes, insurance, and maintenance |

| Cash flow | Monthly rent – Monthly expenses |

| Equity | Total investment – Cash-out refinance |

| IRR | Internal rate of return on the investment |

| Cash on cash return | Cash flow / Total investment |

To use this spreadsheet, enter the relevant information for your property.

The spreadsheet will then calculate the total investment, monthly rent, expenses, cash flow, equity, IRR, and cash-on-cash return.

Buying Through BRRRR Method

The BRRRR method is an investment strategy for buying investment properties. Here are the key steps:

Buy: Find a distressed property that is undervalued and needs repairs. Typically these are fixer-uppers.

Rehab: Renovate and improve the property to increase its value. This often means updating kitchens, bathrooms, floors, and more.

Rent: Once renovated, rent out the property to generate income.

Refinance: Refinance the property to take some of the increased equity out of the property. Use this cash to fund the purchase of the following property.

Repeat: Repeat the process by buying another distressed property, renovating it, renting it out, and refinancing. Continue scaling up by repeating the process.

To buy multiple rental properties through this method:

• Have access to capital. You’ll need funds for down payments, rehab costs, and cash flow between renters.

• Obtain rental property loans and lines of credit. You’ll likely need multiple loans to fund future purchases.

• Find multiple fixer-upper properties for sale in your target area. You’ll need a steady supply of undervalued properties.

• Hire or build a skilled rehab team. You can’t renovate multiple properties yourself.

• Manage multiple properties’ repairs, renovations, tenants, and cash flow. This requires organization and property management skills.

• Track your finances carefully to ensure costs and profits for each property. Have a system to differentiate properties.

Scaling up the BRRRR method takes time, capital, and intensive property management. But if executed well, it can be a lucrative real estate investment strategy to build wealth through rental properties.

Best Ways To Secure Financing

There are many different ways to secure financing for real estate. Here are a few of the most common options:

- Conventional loans: These loans are offered by banks and other traditional lenders. They typically have lower interest rates indifferent heres of loans but also require a down payment of at least 20%.

- FHA loans are insured by the Federal Housing Administration (FHA). They have lower down payment requirements than conventional loans, but they also have higher interest rates.

- VA loans: These loans are guaranteed by the Department of Veterans Affairs (VA). They are available to veterans and their spouses and have no down payment requirement.

- Hard money loans: These loans are made by private investors. They typically have higher interest rates and shorter terms than traditional loans, but they can be a good option for investors who need quick access to cash.

- Home equity loans: These loans are secured by the equity in your home. They can be a good option for investors with home equity.

Tips for securing financing for real estate:

- Get pre-approved for a loan before you start shopping for a property. This will show you how much you can afford to borrow and make the buying process go more smoothly.

- Improve your credit score. A good credit score will make you more attractive to lenders and qualify you for lower interest rates.

- Make a sizeable down payment. A significant down payment will reduce the money you need to borrow, saving you money on interest.

- Shop around for the best interest rate. Interest rates can vary from lender to lender, so comparing rates before choosing a loan is essential.

- Be prepared to provide documentation. Lenders must see proof of their income, assets, and employment history before they approve a loan.

Step 5: Manage Your Properties Effectively

Managing multiple rental properties can be challenging, but ensuring long-term profitability is essential.

You can either manage the properties yourself or hire a property management company to handle day-to-day tasks such as tenant screening, rent collection, and maintenance.

Conducting regular inspections, updating the properties as needed, and developing a plan to attract and retain quality tenants is essential.

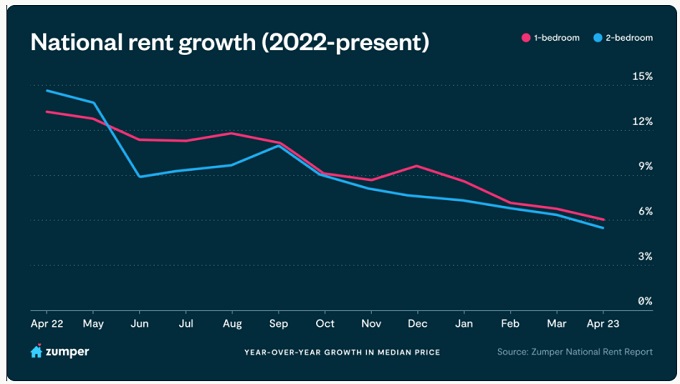

Zillow Reports Rent Moderation in 2023

Despite a rise in typical rent, Zillow reports that a trend to rent moderation is underway in 2023. The company says no rent price declines in major metros and believes this leasing season is going well, with workers returning to big cities to work.

The slowest rent growth was seen in Buffalo, New York (0.1%), Portland, Oregon (0.1%), San Antonio, Texas (0.1%), Sacramento, California (0.2%), and Miami, Florida (0.3%). Most robust monthly rent growth was in Providence, Rhode Island (1.7%), San Diego, California (1.3%), Hartford, Connecticut (1.3%), New York, New York (1.3%), and Boston, Massachusetts (1.2%).

Zillow attributes the moderation in rent growth to several factors, including:

- Increased supply: The number of available rental units has increased in recent months, which has put downward pressure on prices.

- Rising mortgage rates: Rising mortgage rates have made it more expensive to buy a home, which has led some people to rent instead.

- Workers returning to big cities: As the economy recovers, more workers return to big cities to work. This has increased the demand for rental housing in these areas.